Over thirteen yearsexperience in the industry

We can offer aMarket comparison

Accepted bymajority of high street banks

Recognised byUK Finance

What Happens Once You Receive Planning Consent?

Once planning consent is granted, several important steps are involved to ensure that the development proceeds in accordance with the approved plans and conditions.

These include issuing a decision notice, publishing the decision, monitoring compliance with conditions, reviewing additional submissions, conducting site inspections, enforcing conditions, advising on amendments, and handling any appeals.

These steps are crucial to maintaining the integrity of the planning process and ensuring that developments meet the required standards and community expectations.

- Issuing the Decision Notice:

- The case officer sends you a formal decision notice. This document explains the details of the approved planning permission and any conditions attached to it. (The probability of being assigned a case officer varies dependant on your local authority)

- Publishing the Decision:

- The decision notice and approved application details are posted on the local planning authority’s website and public planning register. This keeps the process transparent and lets the public see the results.

- Monitoring Conditions:

- Many planning approvals come with specific conditions that must be met before or during the development. The case officer checks that these conditions are followed.

- Reviewing Additional Submissions:

- Some conditions require submitting extra details, like landscaping plans or drainage designs. The case officer reviews these submissions to ensure they meet the requirements, then approves or rejects them.

- Site Inspections:

- During construction, the case officer may visit the site to check that the development follows the approved plans and conditions. These inspections help ensure everything is up to standard.

- Enforcing Conditions:

- The case officer may take enforcement action if you don’t follow the conditions or deviate from the approved plans. This could involve issuing notices or taking legal steps to fix any issues.

- Advising on Amendments:

- If you want to change the approved plans, the case officer will decide if the changes are minor (non-material) or if you need to submit a new planning application. They will guide you on how to proceed with these changes.

- Handling Appeals:

- If you appeal against any conditions imposed, the case officer prepares the local authority’s case and defends the decision at an appeal hearing. This includes explaining the reasons for the conditions and arguing why they should stay.

These steps are crucial to keeping the planning process fair and ensuring that developments meet the required standards and community expectations.

Local Authorities Most Likely To Serve Enforcements

| Planning Authority | Total number of applications received | Enforcements | % Of Enforcments |

| Barnsley | 181 | 11 | 6.08% |

| Basildon | 179 | 9 | 5.03% |

| Brent | 518 | 41 | 7.92% |

| Broxbourne | 160 | 9 | 5.63% |

| Colchester | 318 | 24 | 7.55% |

| Hackney | 338 | 17 | 5.03% |

| Hartlepool | 50 | 3 | 6.00% |

| Middlesbrough | 89 | 5 | 5.62% |

| Newham | 286 | 15 | 5.24% |

| Slough | 163 | 16 | 9.82% |

Local Authorities most likely not to serve enforcements

| Planning Authority | Total number of applications received | Enforcements | % Of Enforcments |

| Chesterfield | 103 | 1 | 0.97% |

| City of London | 140 | 0 | 0.00% |

| Darlington | 126 | 0 | 0.00% |

| Fareham | 168 | 0 | 0.00% |

| Gosport | 51 | 0 | 0.00% |

| Mansfield | 83 | 0 | 0.00% |

| Melton | 91 | 1 | 1.10% |

| Preston | 168 | 0 | 0.00% |

| Rushmoor | 88 | 2 | 2.27% |

Case Officers Assigned

Case officers are typically assigned early in the planning application process, not just when planning permission has been granted. However, this depends on the local authority and the size of the project you have submitted.

Local authorities that always assign a case officer

| Planning Authority | Percentage of decisions delegated to officers | Total number of decisions granted | Percentage of decisions granted |

| Amber Valley | 100 | 231 | 91 |

| Barking and Dagenham | 100 | 81 | 62 |

| Boston | 100 | 66 | 88 |

| Bristol, City of | 100 | 656 | 80 |

| City of London | 100 | 120 | 98 |

| Fenland | 100 | 124 | 87 |

| Kingston upon Thames | 100 | 206 | 71 |

| Leicester | 100 | 193 | 81 |

| Merton | 100 | 256 | 81 |

| Tower Hamlets | 100 | 161 | 77 |

| Woking | 100 | 151 | 81 |

Local Authorities Less Likely To assign a case officer

| Planning Authority | Percentage of decisions delegated to officers | Total number of decisions granted | Percentage of decisions granted |

| Chesterfield | 87 | 96 | 97 |

| East Devon | 76 | 302 | 86 |

| Harlow | 85 | 61 | 91 |

| Harrow | 83 | 223 | 71 |

| Ipswich | 87 | 105 | 90 |

| Kensington and Chelsea | 87 | 555 | 88 |

| Pendle | 77 | 92 | 75 |

| Portsmouth | 84 | 141 | 89 |

| Rossendale | 85 | 44 | 68 |

| South Ribble | 86 | 135 | 95 |

| Warrington | 87 | 220 | 79 |

MORE RESOURCES PLANNING APPLICATIONS

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

References

Understanding The Planning Application Status

Planning applications are typically categorised based on their status in the decision-making process.

The Planning Stage Status

| Received | Granted | Decided |

| Applications submitted to the local planning authority have not been fully processed or determined | Applications approved by the local planning authority, allowing the proposed development to proceed (usually subject to conditions). | This category encompasses all applications that have reached a final decision, whether approved or refused. It includes both granted and denied applications. |

The “decided” category is significant because it represents the completion of the decision-making process for a planning application. Once an application is decided, it means that:

- The local planning authority has thoroughly reviewed the application

- Any necessary consultations have been carried out

- The proposal has been assessed against relevant planning policies and regulations

- A final determination has been made, either granting or refusing permission

Statuary Time Limits For Planning Applications

It’s important to note that the statutory time limits for deciding applications vary depending on the type of development:

- 13 weeks for major development applications

- 8 weeks for most other types of development (including householder applications)

- 16 weeks for applications subject to Environmental Impact Assessment

The government has also implemented a “planning guarantee” policy, which states that no application should spend more than a year with decision-makers, including any appeal.

This means that in practice,

- Major planning applications should be decided within 26 weeks.

- Non-major applications should be decided within 16 weeks.

These timeframes are designed to ensure efficient processing of planning applications and to provide certainty for applicants. Suppose a local planning authority consistently fails to decide applications on time. In that case, they may face consequences, including the possibility of being designated as underperforming, which could result in applicants being able to submit certain types of applications directly to the Secretary of State.

Planning Applications Key Data Insights (2013-2023)

To provide further context, here’s a summary of key data points from recent years that illustrate trends in the planning application process:

-

Number of Applications and Decisions:

- The peak year for applications received was 2016-17 with 486,681 applications. In 2022-23, this number decreased to 395,854.

- The peak year for applications decided was also 2016-17 with 439,940 decisions. In 2022-23, this number was 377,027.

-

Approval Rates:

- The percentage of decisions granted has been consistently high, mostly around 88%, slightly dropping to 87% in 2022-23.

-

Timeliness of Decisions:

- The percentage of decisions on major applications within 13 weeks decreased from 57% in 2013-14 to 19% in 2022-23.

- The percentage of decisions on minor applications within 8 weeks decreased from 70% in 2013-14 to 36% in 2022-23.

- Overall, decisions within the statutory time period of 8/13 weeks dropped from 78% in 2013-14 to 46% in 2022-23.

-

Performance Agreements:

- The number of decisions on applications accompanied by a performance agreement increased significantly, peaking at 172,108 in 2021-22.

- The percentage of decisions on applications with a performance agreement decided in time remained high, around 90-91%.

-

Decisions within Agreed Time:

- Major applications decided within 13 weeks or agreed time consistently improved, peaking at 89%.

- Minor applications decided within 8 weeks or agreed time stayed high, between 83-89%.

- Overall decisions within 8/13 weeks or agreed time remained high, between 84-90%.

Recommendations:

- Consider Performance Agreements: To increase the likelihood of timely decisions, applicants should consider accompanying their applications with a performance agreement.

- Prepare for Potential Delays: Given the declining trend in statutory time period decisions, applicants should be prepared for potential delays, especially for major applications.

More Resources Planning Applications

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

References

Planning Applications: Why Do They Go to Public Consultation?

Planning applications often go to public consultation for several important reasons:

1. Transparency and Accountability:

Public consultation keeps the decision-making process open and transparent. It lets the public and stakeholders give input and raise concerns about proposed developments, ensuring decisions aren’t made behind closed doors.

2. Identifying Potential Issues and Impacts:

Public input can help spot issues or impacts that might have yet to be considered initially. Residents and community groups often have valuable local knowledge that can highlight these potential problems.

3. Gathering Diverse Perspectives:

Consulting the public brings in a range of viewpoints from residents, businesses, interest groups, and experts. This variety leads to more balanced and well-informed decisions.

4. Improving Proposal Quality:

Feedback from the community can lead to changes or improvements in the proposals, resulting in better project designs that meet community needs and reduce negative impacts.

5. Increasing Public Acceptance and Compliance:

The final decision gains legitimacy when the public is involved in the decision-making process. Often, this leads to greater acceptance and voluntary compliance with the approved plans.

6. Legal and Regulatory Requirements:

Public consultation is legally required in many areas for certain types of planning applications. Skipping this step can lead to legal challenges or delays.

7. Building Trust and Relationships:

Good public consultation builds trust and positive relationships between developers, planning authorities, and local communities. This can make project implementation smoother and foster better cooperation in the future.

While public consultation can take time and resources, it is crucial for a fair, transparent, and inclusive planning process that balances different interests and minimises conflicts.

Do All Planning Applications Go to Public Consultation?

No, not all planning applications require public consultation. It depends on the scale and potential impact of the proposed development.

When Public Consultation is Required:

- Major Developments:

- Larger projects like big residential complexes, commercial buildings, or infrastructure projects usually require public consultation.

- Developments with Significant Impact:

- Proposals likely to significantly impact the local community, environment, or infrastructure often need public consultation.

- Listed Buildings or Conservation Areas:

- Projects involving listed buildings or sites in conservation areas generally require public consultation.

- Environmental Impact Assessment (EIA):

- Developments that need an EIA usually involve public consultation as part of the assessment process.

- Local Authority Requirements:

- Some local planning authorities have specific rules requiring public consultation for certain developments, even if they’re not major projects.

When Public Consultation is Not Required:

- Householder Applications:

- Applications for extensions, alterations, or minor works to existing homes typically do not require public consultation.

- Minor Developments:

- Small-scale projects that fall below the thresholds for major developments and are unlikely to have a significant impact usually don’t require public consultation.

- Permitted Development:

- Some types of development, under permitted development rights, don’t need full planning permission and usually don’t involve public consultation.

Even for smaller projects, local planning authorities might notify immediate neighbours or provide limited consultation if necessary. Applicants should check with their local planning authority to understand their proposal’s consultation requirements.

What Happens When a Planning Application Goes to Public Consultation?

When a planning application goes to public consultation, the following typically occurs:

1. Public Notification:

The local planning authority publicises the application and invites public comments. This is done by posting site notices near the proposed site and publishing notices in local newspapers. These notifications include details about the proposed development, where to view the application documents, and how to submit comments within a specified period (usually 21 days).

2. Public Comments and Representations:

Residents, community groups, and other interested parties can submit written comments or representations. These can express support or objections, raise concerns about impacts, suggest modifications, or provide additional information.

3. Consultation with Statutory Consultees:

The planning authority consults certain statutory bodies, such as highways authorities and environmental agencies, to get expert advice on specific aspects of the proposal.

4. Public Meetings or Exhibitions:

For larger or more controversial developments, the applicant may hold public meetings or exhibitions to present the proposal and gather feedback. These events allow for direct engagement and allow the public to voice their opinions.

5. Consideration of Comments and Responses:

After the consultation period, the planning authority reviews all comments and representations, along with advice from statutory consultees. The applicant may need to address specific concerns, leading to changes or revisions in the proposal.

6. Decision-Making Process:

The planning officer or committee evaluates the application, taking into account the consultation responses, policy considerations, and other relevant factors. A report summarising the key issues and recommending approval or refusal is prepared. The planning authority makes the final decision, either by delegated officers or the planning committee at a public meeting.

Public consultation ensures transparency, accountability, and community involvement in planning decisions, leading to more informed and balanced outcomes.

Planning Approval

Once your plans have been approved then it is time to get your New Build Warranty in place before construction takes place.

Planning Applications: Why Do They Go to Public Consultation, is part of our A Guide To Making A Planning Application

More on Pre Application Discussions

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

References Sources

Key Aspects of Pre-Application Discussions

Purpose and Benefits:

- Understanding Requirements: These discussions help applicants verify the list of local requirements and understand how planning policies apply to their specific proposal. This ensures that they are fully aware of what is needed to move forward with their application.

- Reducing Invalid Applications: These meetings reduce the likelihood of submitting invalid applications by clarifying requirements and potential issues early on. This saves time and resources for both the applicant and the planning authority.

- Identifying Issues: Early identification of site-specific problems, such as roads, footpaths, power cables, watercourses, sewers, and telephone lines, allows applicants to address these issues proactively.

- Specialist Advice: Applicants receive early advice on more complex issues such as listed buildings, neighbouring properties, trees, highways, and flood risks. This specialist input can be crucial in shaping a viable proposal.

- Improving Success Rates: Engaging in the pre-application process significantly increases the chances of ultimate success, as planners value this preparatory step and the effort to address potential concerns beforehand.

Pre-application Discussions Process:

- Informal Meetings: These meetings can be conducted in person, over the phone, or via email, providing flexibility in how discussions about the feasibility of ideas and potential problems are conducted.

- Feedback and Advice: Applicants receive immediate feedback and advice, which can guide the development of their proposal. This includes suggesting alternatives to overcome any identified problems before submitting final designs.

- Documentation: A written record of the advice and discussions is often provided. This documentation can be a material consideration in the formal planning application process, providing a reference point for both the applicant and the planning authority.

Considerations:

- Non-Binding Nature: It’s important to note that the advice provided during pre-application discussions is non-binding and does not pre-empt the formal decision-making process. This means that while helpful, the advice does not guarantee approval.

- Potential Delays: While beneficial, pre-application discussions can delay the submission of the full planning permission application and potentially the start date of the work. Applicants need to factor this into their project timelines.

- Fees: Some local planning authorities charge for pre-application services. These fees and processes can vary between councils, so applicants should check their local authority’s specific requirements.

Engagement and Transparency:

- Community and Stakeholder Involvement: Pre-application discussions encourage the involvement of statutory consultees, town and parish councils, and neighbourhood forums. This ensures comprehensive feedback and fosters community engagement, which can benefit the proposal’s acceptance.

- Confidentiality: Local planning authorities should be transparent about their practices regarding disclosing pre-application discussions. They must balance the need for confidentiality with the benefits of broader community engagement, ensuring that sensitive information is protected while promoting transparency.

DOES EVERY BUILD NEED A PRE-PLANNING DISCUSSION

Only some building projects require a pre-planning discussion or pre-application advice from the local planning authority. The need for pre-application discussions typically depends on the proposed development’s scale, complexity, and potential impact.

Here are some key points about when pre-planning discussions are recommended or required:

- Pre-application advice is not compulsory but is actively encouraged by many local planning authorities, especially for larger or more complex developments.

- Pre-application discussions are generally not required for smaller projects like householder applications (extensions or alterations to existing homes).

- For major developments, developments with significant impacts, listed buildings, or those requiring an Environmental Impact Assessment, pre-application discussions are highly recommended or may even be requiredby the local authority.

- Some local authorities have specific policies or thresholds that require pre-application consultations for certain types or scales of development, even if not classified as major.

- Pre-application discussions help identify potential issues early, ensure policy compliance, and increase the chances of a successful application.

- However, pre-application advice may only be necessary for minor or permitted development works requiring full planning permission.

In summary, while pre-planning discussions are not universally mandatory, they are strongly encouraged for larger, more complex projects to facilitate a smoother planning process and address potential issues upfront. For smaller, routine developments, pre-application advice may not be strictly required but can still be beneficial in some cases.

Pre-application Discussions KEY TAKE AWAYS

Overall, pre-application discussions are an excellent way for applicants to fine-tune their proposals, tackle any issues early on, and boost their chances of getting approved. By participating in these meetings, applicants can get a clearer picture of the planning process, receive personalised advice, and improve their plans to meet planning rules and community needs.

Why they can go to a public consultation

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

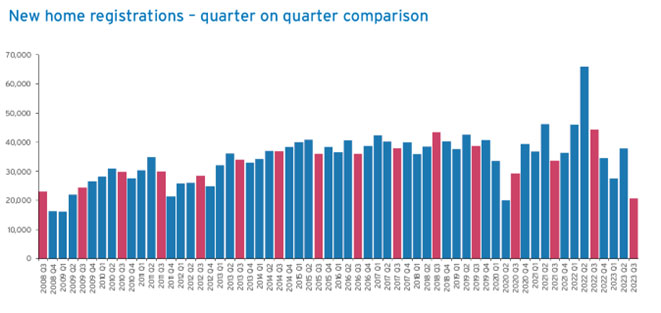

New Build Housing Falls Year on Year But the Signs are More Positive for 2024

- New homes completed in Q3 2023 were down 15% on the same period in 2022.

- New home registrations fell by 53% in the third quarter of 2023 compared to the same quarter in 2022.

- 20,680 new homes were registered in Q3 of 2023 compared to 44,153 in Q3 2022.

- Design development refining the plans.

- Economic factors including interest rates, inflationary pressure, a poor planning system and complex regulations all lead to fewer homes being built.

- In the whole year to December 2023, new build home starts were 16% down compared to the year to 31 December 2022, and completions were 11% down year on year.

- The estimated number of new build completions for 2023 was 231,100, a 9% decrease compared to 2022.

Source: Figures released by the National House Building Council (NHBC)

Positive Outlook for the Housing Market

- Housebuilder sales rates are picking up.

- The pace of build cost growth has slowed significantly.

- UK house prices are stabilising and mortgage rates are coming down.

- Interest rates are levelling off and build cost inflation has eased.

- Opportunities for developers to build now and sell in a few years into a market starved of stock.

- De-risking across large scale projects through block sales.

- Investors and operators in build-to-rent, student and seniors housing will be key.

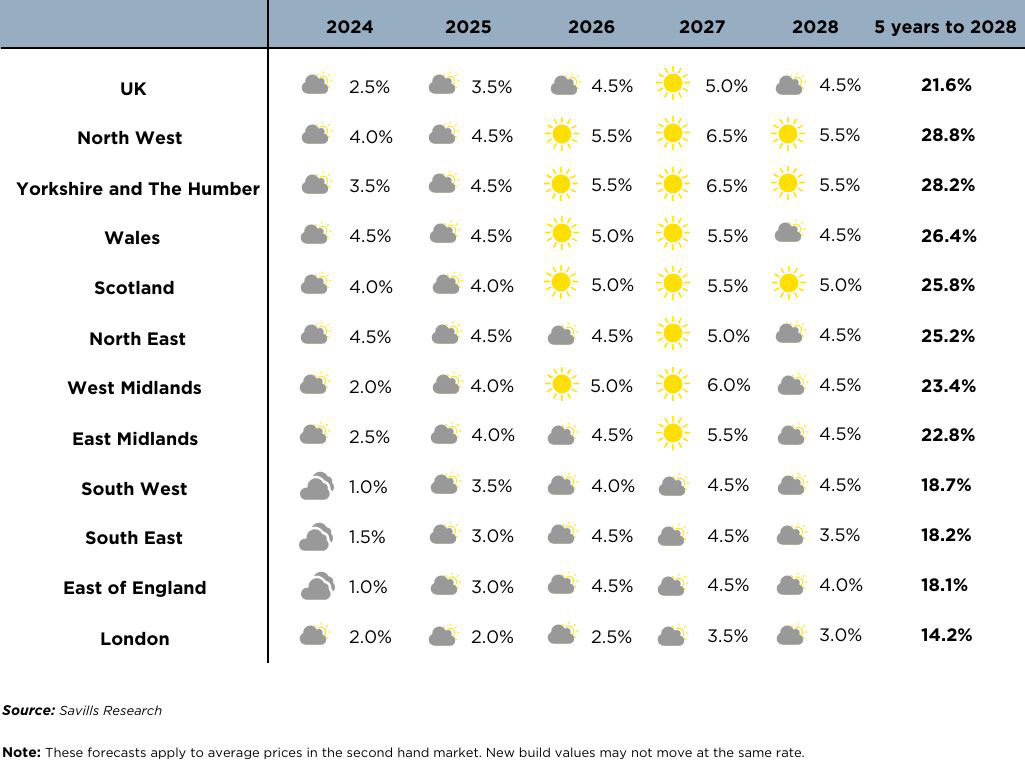

Savills Residential Research also shows a positive increase over the coming 5 years in their Mainstream Capital Value forecast

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information, please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Types Of Planing Application Agents

Planning application agents are an integral part of the planning application. They are there to guide you through the complex rules and regulation which may even vary from each borough and council authority. Getting it wrong in the beginning could and months, even years to the whole process.

So lets explore what type of planning agents there are and when you might need them along with the projected cost implications.

Architect

An architect is someone who has been professionally trained and licensed to plan, design, and oversee the construction of buildings. Their skills, background, and fees can differ quite a bit depending on the size and complexity of the project.

Qualifications:

To become a licensed architect, the typical path involves:

- Earning a 5-year bachelor’s degree in architecture. (BArch) degree accredited by the Royal Institute of British Architects (RIBA) (https://www.architecture.com/)

- Completing an internship under a licensed architect (A minimum of two years of supervised work experience under a registered architect.)

- Passing the licensing exam. (You’ll need to pass the Part 3 qualification exam offered by RIBA. This assesses your architectural knowledge, design skills, and professional competence.)

Experience:

Architects can specialise in residential homes, commercial buildings, or landscape architecture. Their experience can range from recent grads to veterans with decades under their belt.

Costs:

Architect fees are commonly structured a few different ways:

- Percentage of construction cost: This is standard practice, where the architect’s fee is calculated as a percentage of the total estimated construction cost, often 8-15%+ depending on complexity and the architect’s experience.

- Hourly rate: Some architects bill by the hour, with rates varying based on experience and location.

- Fixed fee: For smaller projects, architects may agree to a fixed cost for defined services.

Here’s a rough estimate of fees based on project size:

Here’s a rough estimate of fees based on project size:

- Small residential project (renovation/addition): £5,000 – £15,000+

- Medium residential project (new single-family home): $15,000 – $30,000+

- Large residential project (custom luxury home): $30,000+

- Commercial project: Costs vary hugely depending on size and complexity

What Architects do:

- Initial consultation to discuss vision, budget, needs

- Site analysis to evaluate the property

- Schematic designs with preliminary concepts/floor plans

- Design development refining the plans

- Construction documents with detailed drawings/specs

- Bidding assistance and oversight during construction

When to hire an architect:

- For complex projects requiring specialised design expertise

- If you want a custom, unique design fitting your style

- To ensure permitting and code compliance

Planning Consultants

Planning consultants are specialists who can guide you through the planning/zoning approval process based on their expertise with local regulations and procedures.

Qualifications:

Degree in Planning, Urban Design or related field. Membership in the Royal Town Planning Institute (RTPI). (https://www.rtpi.org.uk/).

Experience: Most have several years working on planning applications.

Cost: Roughly £2,000 – £6,500+ per project depending on complexity

When to hire Planning Consultant

You should consider hiring a planning consultant in several situations related to obtaining planning permission for development projects. Here’s a breakdown of key scenarios where their expertise can be beneficial:

Complex Projects:

- Unfamiliar territory: If you’re unfamiliar with the planning process or local regulations, a consultant can guide you through the steps, paperwork, and potential challenges.

- Large-scale development: For complex or large-scale projects, a consultant can navigate the complexities and increase your chances of approval.

- Sensitive developments: Projects in historically significant areas, environmentally sensitive zones, or with potential for community objections might benefit from a consultant’s experience in dealing with such complexities.

Applications with a High Risk of Rejection:

- Previous refusals: If a similar project on the site was previously rejected, a consultant can analyze the reasons and develop a more successful strategy for your application.

- Non-standard proposals: Projects that deviate significantly from the local development plan or zoning regulations will need a strong case for approval, which a consultant can help build.

Surveyors

Surveyors provide expertise on property boundaries, constraints, and other site conditions.

Qualifications:

Chartered membership with the Royal Institution of Chartered Surveyors (RICS) requiring a surveying degree.

Experience: Qualified surveyors understand building codes well.

Cost: Around £650 – £2,600+ depending on survey type

When to hire Surveyor

Building or renovating: A surveyor can be crucial for:

- Site surveys: This establishes the property’s exact boundaries, topography (land elevation), and potential challenges for construction projects.

- Setting out foundations: Ensures the foundation for your new building is laid in the correct location and at the proper level.

Land development: For any significant land development project, a surveyor is necessary for:

- Land division: Dividing a larger piece of land into smaller plots requires accurate surveys to establish boundaries for each new parcel.

- Topographical surveys: Understanding the land’s elevation and features is crucial for planning construction projects,drainage systems, and overall development.

Landscape Architect

For major landscaping, a landscaping architect creates designs meeting planning requirements.

Qualifications:

Degree in landscape architecture and membership with the Landscape Institute (LI).(https://www.landscapeinstitute.org/about/).

Experience: Experienced in sustainable design and environmental regulations.

Cost: Around £1,300 – £3,000+ based on complexity

Environmental Consultants

Environmental consultants assess potential impacts and mitigation strategies.

Qualifications:

Degree in environmental science/ecology plus relevant certifications.

Many will also have certifications or memberships in relevant organisations depending on their area of expertise. For example, someone specializing in waste management might be certified by the Chartered Institution of Wastes Management (CIWM) (https://www.ciwm.co.uk/).

Experience: Look for consultants experienced with similar projects.

Cost: £1,000 – £10,000+ depending on assessment complexity

What they can do for your planning application:

- Environmental Impact Assessment (EIA): They can assess the potential impact of your project on factors like air quality, water resources, ecology, and noise pollution.

- Pollution control strategies: They can advise on ways to mitigate any negative environmental impacts and ensure compliance with environmental regulations.

- Sustainability reports: They can help develop reports that demonstrate your commitment to sustainable practices, which can be a positive factor in the planning decision.

When might you need an environmental consultant?

- If your project involves development in a sensitive ecological area.

- If your project has the potential to generate significant waste or air/water pollution.

- If your local planning authority requires an EIA for your type of project.

Building Engineers

Building engineers don’t typically work directly on submitting planning applications themselves. Their expertise is more involved in the design and technical aspects of the building itself, once the planning permission is secured.

Qualifications:

- Building engineers typically hold a degree in Civil Engineering, Mechanical Engineering, or a related field. They might also be members of professional bodies like the Chartered Institution of Building Services Engineers (CIBSE) (https://www.cibse.org/).

- Cost: Their involvement wouldn’t be a separate cost for the planning application process. Their fees would likely be part of the overall project cost for design and construction, which can vary significantly depending on the project size and complexity.

Structural Engineers

Structural engineers specialise in a building’s structural integrity and safety.

Qualifications: Chartered Civil/Structural Engineering degree and registration with the Institution of Structural Engineers (IStructE). (https://www.istructe.org/).

Experience: Look for direct structural engineering project experience.

Cost: Around £1,300 – £6,500+ depending on complexity

Notes On Cost Estimations

- Costs can vary significantly based on location, project specifics, and the professional’s experience level

- Get multiple quotes before deciding

- Some firms offer combined services which can save money

- Don’t hesitate to ask about qualifications and relevant experience

When to hire Structural ENGINEER

When to hire Structural ENGINEER

You should hire a structural engineer when your project deals with the building’s stability and structural integrity. Here are some common scenarios where their expertise is crucial:

-

New Builds: For any new construction project, a structural engineer is essential. They will:

- Analyze loads and stresses on the building from weight, wind, and other factors.

- Design the building’s structural framework, including foundations, beams, columns, and floors.

- Specify the appropriate building materials for strength and durability.

- Ensure the building complies with building codes and safety regulations.

-

Renovations and Extensions: If your renovation project involves changes that impact the building’s structure,you’ll need a structural engineer. This could include:

- Removing load-bearing walls

- Adding a new floor or roof

- Modifying existing support structures

- Adding features like balconies or large windows

-

Structural Repairs: If you suspect or discover structural damage to your property, consulting a structural engineer is essential. They can assess the damage, determine the cause, and recommend solutions for repair or reinforcement.Examples include:

- Cracks in foundation or walls

- Uneven floors or sagging ceilings

- Signs of water damage that might affect structural stability

Caveats

- The above are estimated costs and can vary depending on your location, the project’s specifics, and the professional’s experience level.

- It’s always best to get quotes from several professionals before deciding.

- Some firms offer combined services (e.g., planning consultant and surveyor), which can be more cost-effective for smaller projects.

Remember, the qualifications and experience required can also vary depending on the project’s complexity and local regulations. Feel free to ask potential agents directly about their qualifications and experience.

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

The poorly thought out Conservative Government Health and Safety Rules regarding shrinking the size of windows in new developments look set to be scrapped.

Michael Gove’s plans to make upstairs windows at least 1.1 metres from the floor are leading to new developments having smaller windows with dark and gloomy interiors.

It was feared that global warming would lead to more windows being opened for longer that led to the regulations being introduced. However a review is due to be published shortly and industry hope is that this strange rule will be axed.

Some critics have said new homes that have been built adhering to the new rules, have upper storey windows that appear squashed in appearance.

Options to get around the regulations cost money and lower budget properties will suffer as developers are not prepared to invest more money.

Rico Wojtulewicz, spokesperson for the National Federation of Housebuilders said the regulations are “making it difficult …. to deliver unique and beautiful homes.”

Also there is confusion with Local Authorities and Building Control who fail to understand the new regulations.

The Housing Department will publish their report later this year, hopefully providing a better result for the development sector.

References

- Gove

- Wojtulewicz

- Planing Portal – Doors -Windows, Here

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Housing market outlook more positive for 2024

The reduction in rates from the mortgage lenders has brought a cautionary optimism to the outlook for the housing market in 2024.

The Halifax announced a reduction of 0.83% for its 2, 5 and 10 year fixed rate products increasing to 0.92 per cent for existing customers.

The Halifax also confirmed it will be reducing its remortgage rates by up to 0.32% on selected 3-year fixed rates from Friday, 5th January 2024. This mid range fixed rate is not offered by many lenders and is often seen as good middle ground for those looking to remortgage.

All this activity looks likely to prompt other lenders to follow suit.

With inflation falling faster than expected pressure is on the Bank of England to reduce interest rates and encourage further falls in mortgage rates.

Competition amongst lenders is fierce with in a smaller market place – first time buyers with a mortgage fell to a 10-year-low of just 290,000 in 2023.

Despite market indicators still showing a negative trend, sales expectations are looking positive for the first time in three months with a rise of 6% expected and looking toward the future, a 24% increase in sales is forecast in the next twelve months, the most positive outlook since January 2022.

According to Rightmove the number of homes being listed by estate agents on Boxing Day 2023 has nearly tripled (+173%) since pre-pandemic 2019.

Although house prices still look set to continue in decline the rate of decline is slowing.

According to Simon Rubinsohn, RICS chief economist, “The latest RICS Residential Market Survey provides further evidence that sentiment is a little less negative than previously was the case with, critically, the new buyers enquiries indicator finally beginning to stabilise.

“This is being aided by increased confidence that the interest rate cycle has peaked which is reflected in somewhat more competitive mortgage products coming to the market.

“However, with the cost of money likely to remain elevated for some time to come and the economic outlook still downbeat, it is not surprising that the overall tone to the anecdotal remarks from survey respondents is still quite cautious.”

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Blue Chip Developers Will Fall Short of Building Targets in 2024

- Forecasts from Peel Hunt show the 10 stock market listed developers are expected to build only 69,300 new residential dwellings in 2024.

- This falls far below the 85,000 completed in 2022 and is still less than the 71,000 completed in 2023.

- This significant reduction seriously jeopardises Government targets of 300,000 new homes being built each year by all developers by mid-2020’s.

- Companies blame withdrawal of Help to Buy, planning red tape, Brexit and lack of skilled labour as significant reasons for lack of homes being built – the environment is increasingly anti-development.

- Other causes for the shortfall include cost of living crisis, mortgage rate rises, falling house prices and shortage of housing stock.

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Loft conversions – do they still make financial sense?

When looking to increase space in your home one of the most popular choices has often been to go upwards into the loft, but with soaring building and timber costs does this still represent value for money?

Average building costs are around £250-£300/sq ft so a couple of bedrooms and a bathroom could cost around £120,000 but could add around £150,000 to the value of the home thereby making this a good investment.

Adding an extra bedroom and bathroom to a smaller house will be more likely to increase its value as you are widening its appeal to a larger market sector. However, adding too many bedrooms and having not enough living space to accommodate everyone or ending up with an unbalanced home or overdeveloped plot will not be attractive to buyers, even if it works for you.

In the current market, with falling house prices, a loft conversion in some areas is unlikely to add value in the short term but stay put for a few years and a well-balanced conversion is likely to give you a good return on your investment.

As is the case with all significant building projects, you will need a structural warranty. Please contact Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Copyright © 2024 Granite Building Warranties

Supported by Fox 360 Ltd

Granite Building Warranties Ltd is an Appointed Representative of Richdale Brokers & Financial Services Ltd which is authorised and regulated by the Financial Conduct Authority.

Granite Building Warranties is a company registered in England and Wales (Company Number 11497543) with its registered office at 1st Floor, 5 Century Court, Tolpits Lane, Watford, WD18 9PX