Over thirteen yearsexperience in the industry

We can offer aMarket comparison

Accepted bymajority of high street banks

Recognised byUK Finance

The Party Wall Act

What Exactly Is a Party Wall Agreement?

The Party Wall Act states there are two types of party wall, as follows:

Party Wall type A – This is a “party wall” if it stands astride the boundary of land belonging to two (or more) different owners. For example, if a wall;

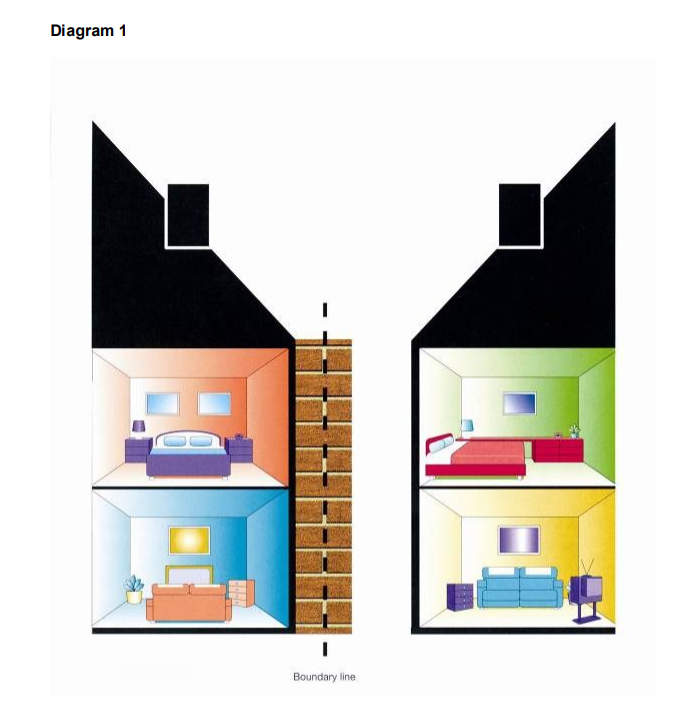

- is part of one building (see diagram 1),

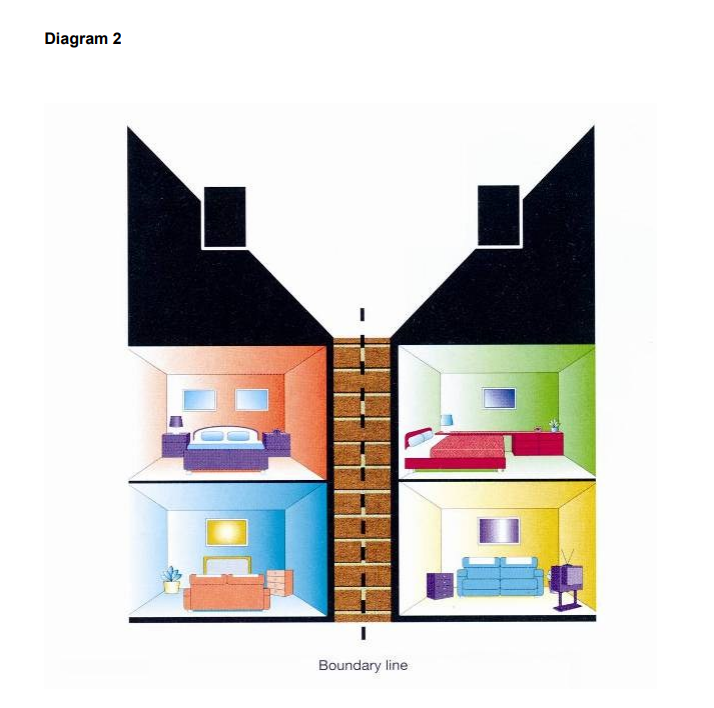

- separates two (or more) buildings (see diagram 2),

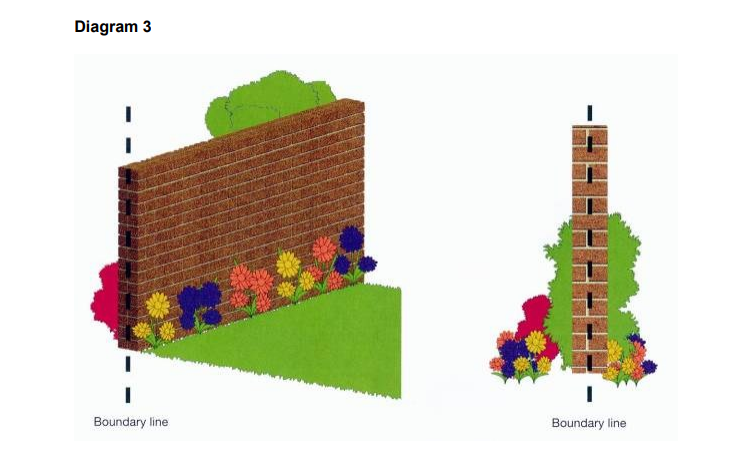

- or consists of a “party fence wall” (see diagram 3).

A wall is a “party fence wall” if it is not part of a building, and stands astride the boundary line between lands of different owners and is used to separate those lands but excluding hedges and timber fences.

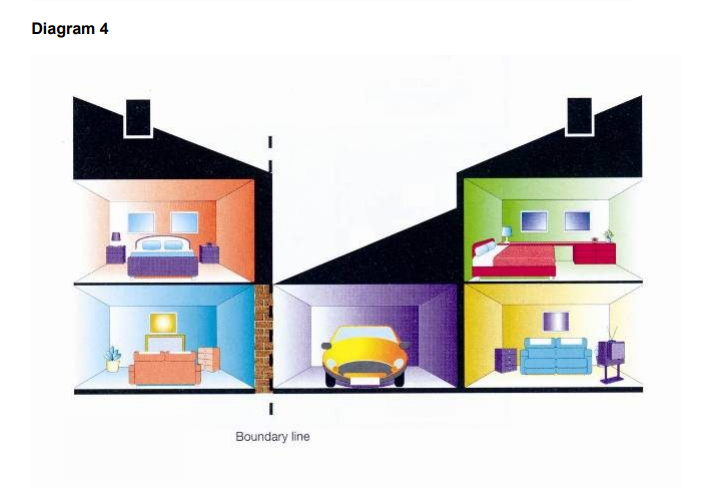

Party wall type B – This is also a “party wall” if it stands wholly on one owner’s land, but is used by two (or more) owners to separate their buildings (see diagram 4). Only the part of the wall that does the separating is “party” – sections on either side or above are not “party”.

The Party Wall Act also uses the expression “party structure”. This is a wider term, which could be a wall, floor partition, or other structure separating buildings or parts of buildings approached by separate staircases or entrances, for example flats (see diagram 5).

What does the Act cover?

- Work that is going to be carried out directly to an existing party wall or party structure

- New building at or astride the boundary line between properties

- Excavation within 3 or 6 metres of a neighbouring building(s) or structure(s), depending on the depth of the hole or proposed foundations

Do You Require a Party Wall Agreement?

If you intend to carry out work that falls within the above categories, you must inform all Adjoining Owners in writing about what you intend to do. You will need to engage a Party Wall Surveyor and you must serve the notice at least two months in advance of any planned work. The Adjoining Owners are within their rights to also instruct a PW Surveyor and you will need to cover this cost in order to agree with the proposed building works. A Schedule of Condition will also be required. If no agreement is reached, a dispute is deemed to have arisen and a surveyor must be instructed to resolve the dispute with an award which is final and binding.

A party wall agreement will need to be in place, if required, where a building warranty is required for the new works. For further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

How To Prepare For a Successful Building Project

Great News! You now have your planning permission, but there are still several important stages to complete before you actually begin your build.

Finding the Right Contractor

If you have not undertaken a construction/self-build project before it is essential that you find the right contractor for the job. Ensure that references are followed up before you engage the builder, check their financial standing and if possible visit previous sites to see examples of completed work and talk to previous clients.

Contractors asking for a large cash deposit in advance could be a sign that they are struggling, but similarly the contractor needs to know that you have the money to settle your account once the work is done. There are companies you can register with who offer secure transaction and payment facilities which protect both the contractor and client.

Alternatively, breaking the project down into stages (or monthly payments agreed between contractor and project manager) is a good way for both parties to keep control of the finances. Remember the process of securing a contractor, receiving quotations and following up on references can take several months to complete.

Planning Conditions

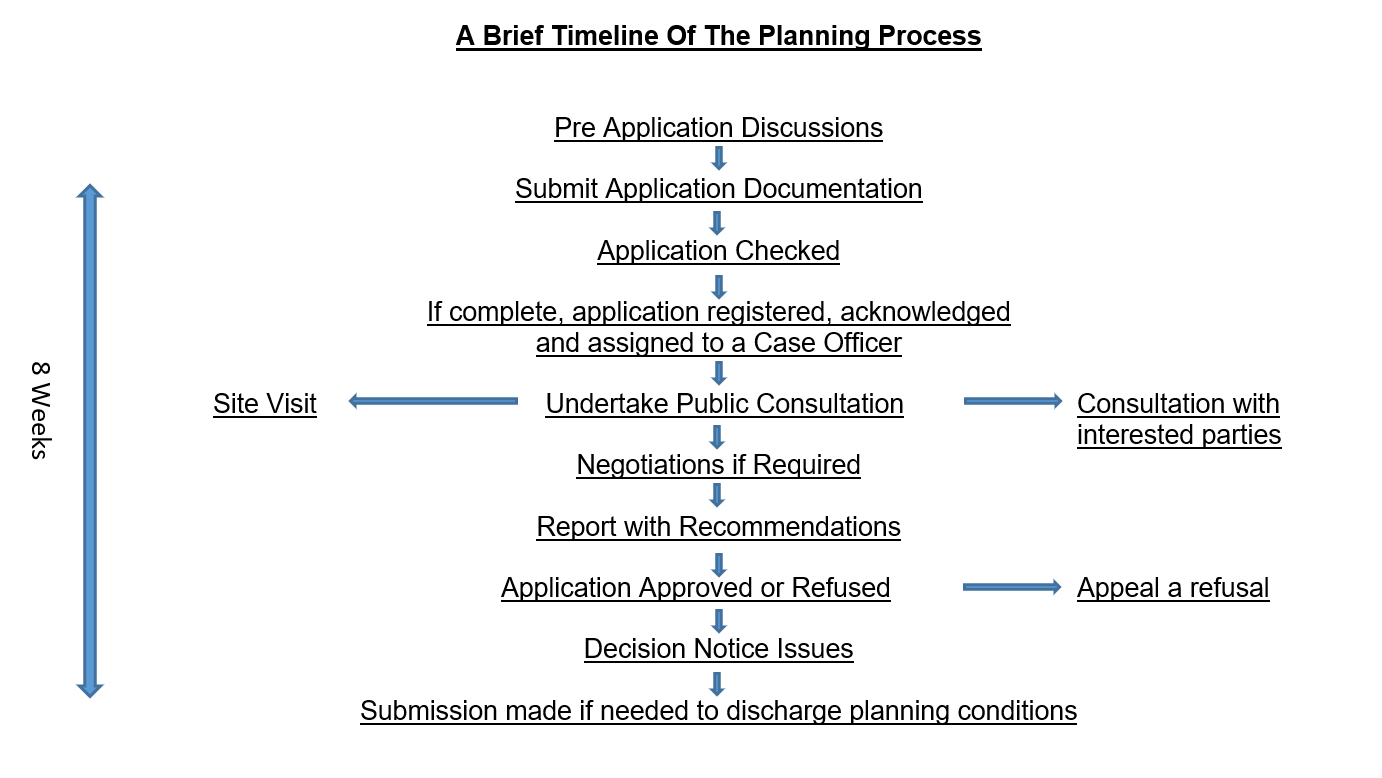

Every planning permission will have Planning Conditions that need to be discharged prior to starting building. These will require an application to the planning department, taking up to 8 weeks, so allow plenty of time leading into the project.

Project Managing the Build

Once you have your contractor in place you need to consider who will project manage the build. A project manager handles the planning conditions, building regulation coordination and execution of a construction project to ensure the work is completed on budget, on time and in accordance with Building Regulations.

If you take on this role yourself you must be prepared to commit a considerable amount of time (and stress) to the project but it will help reduce costs. Alternatively the contractor, or another professional such as a surveyor, can be employed to manage the project for you. This will reduce the stress, but increase the cost by up to 20%. Crucially, a project manager is responsible for ensuring all planning permissions, site insurances and warranties are in place before building commences.

Building Warranty

You will need to put a 10 year structural warranty/latent defects policy in place at the beginning of the process. A mortgage lender will insist on this and Granite Building Warranties will provide a number of New Build Warranty options depending if you are a self-builder or developer builder for onward sale.

Building Regulation Drawings

You will need your architect or architectural technician to prepare drawings for Building Regulation submission. These are far more detailed than planning drawings (effectively construction drawings) and will need to be checked and approved by your appointed Building Regulation Surveyor prior to starting on site.

Building Regulations and Building Control

A Building Regulations inspector will ensure that all building regulations are complied with both before and during the build. Building regulations are minimum standards for design, construction and alterations and apply to almost every building project.

The regulations are developed by the UK government to ensure minimum technical standards are met. Building control operates in 2 stages – first, the plans stage whereby the applicant must submit detailed plans for approval and then the inspection stage, where a series of visits are made to the site to check that work is proceeding in accordance with the plan and regulations.

Completions certificates are issued upon completion of the build. No sale can take place until they are issued.

Site Insurance

If you are undertaking a self-build in addition to a building warranty you will need site insurance. This can be arranged in conjunction with the warranty and cover you against theft of tools or plant, damage or fire to the building and third party liability.

The Way Forward

Here at Granite Building Warranties we are happy to help you source building control either through your local authority or through an approved inspector. We can also help to arrange any Building Warranties or Insurance Cover you may require.

For further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

A Guide To Making A Planning Application

How To Submit An Application

Applications are often made through an ‘Agent’, such as an architect but can also be made by the owner of the site/property.

Applications can be made either online at the National Planning Portal or by submitting paper copies of all documentation. Remember if paper applications are made you will be required to submit up to 4 copies of each document depending on the individual Council. (More on Planning Application Agents)

What Type Of Application Do I Need?

If you know what you are proposing to build and have detailed drawings you will need to make a ‘Full’ application.

If you wish to see what the Council thinks about the proposal initially you can arrange a Pre App meeting for a fee or submit an ‘outline’ application. A further application will need to be made at a later date for ‘reserved matters’ approval prior to the start of the project.

What Documents Will Be Required?

- Completed Application Form

- A site location plan with the proposed application site outlined in red at a scale of either 1:1250 or 1:2500

- A Block Plan showing more detail and at a scale of 1:500

- Elevation and roof plan drawings, existing and proposed, at a scale of 1:100

- The correct fee

Some additional information may be required; for example tree survey, contamination report, ecological report, highways strategy/travel plan or a flood risk assessment.

Final Checking

Ensure that the application form is signed and dated and that any other interested parties have been served notice before submitting. If paper applications are to be submitted please ensure there are the correct number of copies of plans provided.

Planning Conditions

Once you have received your planning consent there will be various conditions which will have to be discharged prior to commencement.

You may also be interested in reading our guide on how to Prepare for a Successful Building Project.

More Resources on Planning

Understanding The Planning Application Status

What Happens When You Receive Your Planning Consent

How a case officer helps with planning

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

A Guide to Retrospective & Replacement Building Warranty Cover

Why do I need retrospective cover?

A Retrospective Building Warranty is essential if you intend to Sell or Refinance a property that has been built in the last 10 years and does not have a recognised 10 year structural warranty in place.

Lenders will not agree to provide funds without a completed housing warranty in place that covers the structure of the property or excludes the owner/lender from potential future liability for structural issues. Without a warranty it will be almost impossible for a buyer to obtain a mortgage.

The Warranty can be arranged by either the owner or purchaser of the property through Granite Building Warranties.

How long is the policy?

Cover is provided for the balance of the 10 year period from the date of Building Regulation Sign Off.

Is the policy transferable?

Retrospective structural defects warranties are completely transferrable to any new owners of the property over a 10-year period, as the certificate is attached to the home rather than the person who takes out the construction insurance.

What does the policy cover?

The cover protects the property in the event of a structural defect or latent defect as a result of a defect in the design, workmanship or construction of the home.

The process and timing

Prior to the insurance being issued, a nonintrusive structural survey will be undertaken by the insurance company.

The surveyor will assess the design and physical condition of the building, to ensure its structural integrity and compliance with the warranty requirements. They will also require copies of all the relevant certificates (Building Regulation Sign Off, EPC, Gas and Electric certificates etc). If the survey raises any problems, then minor remedial works may be required prior to cover being offered, (confirmed usually by photographs) or existing issues can be excluded from the policy.

A Certificate of Insurance will then be issued covering the balance of the 10-year period from completion of the build.

From instruction to proceed the process can take between 5 – 15 working days.

Can I replace an existing invalid warranty cover if necessary?

A replacement or retrospective warranty can also be used to replace a warranty that has become invalid due, for example, to the financial failure of the original insurer. If this should happen and you are an owner of a property in this situation, it will be a requirement of your mortgage lender that the invalid warranty must be replaced with another structural warranty policy for the remainder of the term (please check with your mortgage company as a matter of urgency). In this situation Granite can assist with the new policy and the process will be the same as above.

Granite Building Warranties are Specialists within the Retrospective and Replacement Warranty Market, dealing with these types of policies on a regular basis and we will be happy to help you with any questions you may have. Contact us today for your no-obligation Building Warranty quote.

Please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

Confused by Building Warranties? A Broker Can Help! (Save Time & Money)

Building a new property is exciting, but navigating the world of building warranties can be overwhelming. The process can quickly become stressful, from understanding complex terms like “defects period” and “CML approval” to comparing different policies.

At Granite Building Warranties we understand this. To help you understand this essential mortgage lender requirement and detail surrounding it; the one to two year defects period and CML approval (amongst other requirements), we can support you with the following:

1) Get Free, Competitive Building Warranty Quotes

A free quote from Granite Building Warranties comes with no obligation to use our services. We know the ins and outs of the building warranty industry, and we’ve built strong relationships with leading insurers. Because of that, we can get you a clear comparison of different warranty options. Think of it as having an expert by your side, helping you understand the coverage details and choose the policy that best protects your project.

Here’s what you gain:

- Save Time & Money: We handle the research and comparisons, freeing your valuable time. Plus, our network might unlock competitive quotes you wouldn’t find alone.

- Expert Insights: Benefit from our in-depth knowledge of the building warranty market. We’ll explain different policies and answer any questions you may have.

2) Unbiased Comparisons: Choose the Best Warranty for Your Project

Unlike some brokers who are tied to specific insurance companies, Granite Building Warranties operates as an independent broker. This means we work for you, not the insurers. We have access to many reputable, A-rated insurers, allowing us to present you with various unbiased warranty options.

Here’s what this means for you:

- Tailored Solutions: We focus on finding the best fit for your project’s needs, not pushing a pre-determined policy.

- Transparent Comparisons: We present clear, unbiased comparisons of different warranties, highlighting key coverage differences and pricing.

- Confidence in Your Choice: With our impartial guidance, you can choose the building warranty that offers the optimal balance of coverage and value.

3) Building Warranty Expertise: Streamlining Your Process

At Granite Building Warranties, our team boasts extensive experience in structural warranties. This is how it benefits you:

- Precise and Accurate Information: We provide in-depth, easy-to-understand explanations of various warranty products and their coverage details. No more deciphering complex insurance jargon!

- Handling Complexities with Confidence: We’re well-equipped to navigate even the most intricate warranty situations and answer your specific questions with clear solutions.

- Faster Turnarounds: Leveraging our experience and established relationships with insurers, we can expedite your application process, saving you valuable time.

- Streamlined Paperwork: We’ll guide you through the necessary paperwork and ensure your application is submitted accurately and efficiently, avoiding delays.

4) Dedicated Support Throughout Your Building Journey

At Granite Building Warranties, we prioritise exceptional customer service. That’s why you will have a dedicated account manager who will guide you throughout the entire process, from your initial inquiry to your final warranty certification.

Your personal account manager will:

- Clearly Explain Your Options: They’ll take the time to break down different warranty coverages in a way that’s easy to understand, ensuring you have complete peace of mind about your choices.

- Tailored Recommendations: Because every project is unique, your account manager will work closely with you to identify the warranty that best suits your development’s specific needs and specifications.

- Seamless Communication: You’ll have a single point of contact for all your questions and concerns, making the entire process smooth and stress-free.

5) Cost efficient

It’s important to remember that using a broker goes beyond just saving money. You also gain valuable expertise, streamlined processes, and peace of mind throughout the journey.

Granite Building Warranties: Your Partner in Building Success

At Granite Building Warranties, we believe in making your building journey smooth and stress-free. With our free, competitive quotes, expert negotiation, and commitment to finding the right fit for your project, we can help you save money on your building warranty without compromising quality.

FAQ

What is CML Approval?

CML (Council of Mortgage Lenders): The CML was indeed an industry body that represented mortgage lenders in the UK. It played a significant role in shaping mortgage policies and practices. In 2017, the CML merged with other financial organisations to form UK Finance, which now represents a broader spectrum of financial services.

What is a defects period?

The defects period, also known as the rectification period, refers to the initial timeframe in a structural warranty where the builder is responsible for fixing most defects in a new build property. The defects period typically lasts for one to two years from the practical completion of the construction. This period allows time for any potential issues to manifest after the initial build is finished.

How long does it typically take to get a building warranty approved?

The turnaround time for approval can vary based on the project complexity and the warranty provider. However, it usually takes 2-4 weeks for an initial decision.

What are the benefits of using a building warranty broker?

There are several advantages to using a broker:

- Expertise: Brokers have in-depth knowledge of the building warranty market and can help you compare different options.

- Unbiased guidance: Independent brokers work for you, not the insurers, ensuring you receive unbiased recommendations.

- Time-saving: Brokers can handle the research and comparisons, freeing up your valuable time.

- Negotiation: Some brokers can negotiate on your behalf to potentially secure better deals.

Streamlined process: Brokers can guide you through the application process and ensure it’s completed accurately and efficiently.

.

If you’d like some help picking the perfect building warranty for your requirements, feel free to call us on 01284 365345 or email us here.

Help to Buy Versus Shared Ownership

Help to Buy has offered a fantastic opportunity to buyers to enable that first step onto the housing ladder. Started in 2013, it offers home buyers with a 5% deposit a 5-year interest free government loan of up to 20% of the purchase price of a new build property. However, with the scheme set to end in 2023, is there an alternative for these new buyers? Help to Buy has now ended.

Shared Ownership is one option to consider instead of Help to Buy. This allows earners with less than £80,000 per year in income (£90,000 in London) the opportunity to purchase a share of a home (usually between 25 and 75 per cent) from a housing association and pay rent on the rest.

Compared to Help to Buy where you need a minimum deposit of 5% of the entire property cost, with Shared Ownership you only need a deposit for the share of the property that you are buying.

For example, a property with a purchase price of £200,000:

- Help to Buy – Requires a 5% deposit of £10,000

- Shared Ownership – Requires a 5% deposit of £2,500 for a 25% share

There is the opportunity to increase your share of the home in increments of 10% which reduces the rent payable, but this involves additional costs of legal fees, valuation fees and mortgage fees.

In both cases there are costs to be considered – rent to be paid on the remaining share of a shared ownership property as well as the consideration of service charges associated with leasehold properties (all shared ownership properties are leasehold) and the mortgage on the remaining value of your slice of the property. With Help to Buy, as well as the mortgage payments, interest will be payable on the government loan after five years and the original lump sum will need to be repaid at the end of the term.

Ultimately, both options offer an opportunity to get onto the housing ladder and shared ownership is a great option for those with a smaller deposit.

Copyright © 2024 Granite Building Warranties

Supported by Fox 360 Ltd

Granite Building Warranties Ltd is an Appointed Representative of Richdale Brokers & Financial Services Ltd which is authorised and regulated by the Financial Conduct Authority.

Granite Building Warranties is a company registered in England and Wales (Company Number 11497543) with its registered office at 1st Floor, 5 Century Court, Tolpits Lane, Watford, WD18 9PX