Over thirteen yearsexperience in the industry

We can offer aMarket comparison

Accepted bymajority of high street banks

Recognised byUK Finance

First Time Buyers Not Put Off By Rising House Prices

The Key Statistics

According to the Halifax First-Time Buyer Review 2021:

- First time buyers (FTBs) increased by 35% on the previous year, despite the rising price of property.

- The average FTB is now 32 years old, up from 29 a decade earlier, and is now over 30 years old in every UK region.

- The average deposit is £53,935 – a fall of 6%.

- Rising 3%, the average house price is now £264,140.

- Each region in the UK saw an increase in new buyers. London saw the largest increase of 49%, and Scotland the smallest at 24%.

Esther Dijkstra, Mortgage Director at Halifax, said there were a number of factors influencing home buying decisions in 2021.

“The Stamp Duty holiday increased the availability of first-rung homes as others moved up the ladder. However, undoubtedly, the biggest drivers are the cost of homes and the need to save a significant deposit to get on the housing ladder.

In 2021, the increase in average house price to £264,140, combined with difficulties in raising a deposit, meant that the gap between purchase price and deposit widened in every region in the UK.”

The average price to earnings ratio for UK first-time buyers now stands at 6.9x. Affordability in all but three local authorities has fallen since 2011. In some authorities it has almost doubled, meaning affordability has halved. The least affordable local authority for FTBs is the London borough of Brent, where homes are 12.3x average earnings!

Source: Halifax First-Time Buyer Review 2021 (lloydsbankinggroup.com)

However, despite all the difficulties it would appear that the desire to own your own home remains as strong as ever in the UK.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

New Homes Ombudsman Service

What it is and How it Can Help

Further to the Government’s new Building Safety Bill introduced in July 2021, a new service has been set up to enforce a new housebuilding industry code of practice.

According to the Government, the New Homes Ombudsman will:

- Provide dispute resolution to, and determine complaints by, buyers of new build homes against developers.

- Require developers to become and remain members of the scheme.

- Provide complainants, whose complaints are determined to be well-founded, with a form of redress.

The New Homes Quality Board has announced that The Dispute Service has been selected to be the New Homes Ombudsman, following a fiercely competitive tendering process. The New Homes Ombudsman will enforce the New Homes Quality Code.

Buyers of new build homes who are unhappy with their new home, or frustrated with the way in which the developer has handled their complaint, will be able to ask the New Homes Ombudsman to look at their case. The Ombudsman will look at issues such as whether customers have been treated fairly by their builder. They will also rule on whether there has been a breach of the new code.

Hopefully this will encourage higher building standards and better customer service from the housing developers.

Currently, most new build homes are issued with a 10-year new-build warranty. In future, as a condition of obtaining a warranty, a developer will have to join an industry-led code that their warranty provider belongs to.

Here at Granite, we will ensure that all the warranty providers we use will belong to this code, when this new service is up and running.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

New Legislation to Impact on the Construction Industry

The Building Safety Bill, introduced into the House of Commons in July 2021, is an attempt by Government to overhaul current regulations on how residential buildings, especially higher risk, high-rise buildings, are constructed, maintained and made safe. This comes as a direct response to the Hackitt Report’s investigation into the terrible fire at Grenfell Tower in 2017.

There will be tougher penalties for those companies that fail to meet the new standards, including potential criminal charges. Homeowners will also have a greater say in how their buildings are managed and maintained.

Building owners will need to show clear lines of responsibility for safety throughout the building’s lifetime. They will also need to demonstrate what measures they have in place to manage the ongoing safety risks.

The Health and Safety Executive (HSE) will become the new regulator; taking on responsibility for the building control of all high-rise buildings and resourcing expertise from the fire service, building control and environmental health to become the newly qualified Registered Building Inspectors that will be required.

The Bill provides a framework for the changes, but there is a lack of detail. This makes it difficult to understand its full impact on the construction sector.

Whilst the primary aim is to address safety in higher risk buildings, there will be an impact from this Bill on all who work in design, construction, and maintenance of buildings in the future.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

New Government Initiative – Home Building Fund

As part of the Spending Review, the Government has announced a National Home Building Fund investing £7.1 billion over 4 years. This will shake up the housing market, unlock brownfield land for development, and support new and innovative construction techniques.

According to the Government, this new funding will be available to:

- Support up to 660,000 jobs and unlock up to 860,000 homes.

- Offer £2.2 billion of loans for small and medium enterprises (SMEs) and innovative housebuilders.

- Offer an additional £100 million of grant funding in 2021-22 for unlocking brownfield sites.

- Make available £4 billion Levelling Up Fund that will invest in local infrastructure.

- Help protect the most vulnerable in our society by announcing an additional £254 million of resource funding to tackle homelessness and rough sleeping.

- Support local councils with access to an additional £2.2 billion to deliver core services.

- Make homes safer by providing an additional £70 million to help set up new regulators, build a new regulatory regime, empower residents to raise safety concerns, and help remove dangerous cladding.

Let’s hope it fulfils its promise and is as easy to access as the government implies!

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

Mega Projects Swallow Up Supplies

Image Source: hs2.org.uk

HS2 and Hinckley Point add pressure on supply chains for valuable building materials which continues to impact smaller projects.

- HS2 expected to use 20m tonnes of concrete – as much as Britain produces in a year.

- Large contractors order and agree prices in advance, leaving smaller suppliers with nowhere to go for sand and cement.

- Chinese imports are falling behind after factory closures during Covid.

- The Highways Department (Government body) are ‘second in the queue’ to HS2 and Hinckley Point.

- HGV driver shortage and an explosion in demand is adding to the pressure.

- Double digit price rises expected to hit the construction industry next year as a result of the fuel crisis.

- British Merchants Federation (BMF) and Construction Products Association (CPA) set up a task force to help monitor the situation with the Government and the major building projects.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

Subsidence and How to Spot the Signs

Subsidence – the word most feared by homeowners and home buyers alike! But does it have to be such a horror story and are there ways we can avoid it?

What is Subsidence?

What is Subsidence?

Subsidence is when the ground beneath a property becomes unstable and sinks. This causes the foundations to move out of alignment and the building to ‘subside’.

The increasing problems of climate change – hotter, drier summers, and wetter winters – is increasing the risk of subsidence and claims are on the rise. Many homeowners are unaware of the signs of subsidence and the steps that can be taken to reduce the risks; and who to contact if you think there is a problem.

Yes heatwaves can contribute to increased subsidence. (Data Source) ABI (Association of British Insurers)

The Signs of Subsidence

One of the most common signs of subsidence will be visible cracking. But unlike normal cracking caused by plaster drying out and settling, the cracks will be wider than 3mm, visible from inside and outside the property, often diagonal and often starting from windows or doors.

Other signs will include windows sticking when opening and closing, floors dropping away from skirting boards, pooling water outside and paving slabs dropping on one side.

How to deal with subsidence?

If the signs are there, it is vital not to ignore them. You should contact either your insurer (assuming your insurance covers subsidence) or a qualified professional surveyor to come and assess the situation and how it can be sorted out. Contrary to popular opinion, underpinning is only needed in the worst cases of subsidence. Often the problem is caused by tree roots or a leaky pipe; so the problem can be remedied relatively quickly and easily using the correct professionals.

Data on Subsidence Claims

In a typical year, 60% of valid subsidence claims will be due to root induced clay shrinkage. 18% will be due to leaking drains / mains water supply pipe. 18% will be due to poor ground, infill and consolidation issues whilst the remaining 4% will be due to other causes such as heave, landslip, sinkholes or mining issues. (Source)

Most At Risk Subsidence Locations

Based on 2022 data from LV, these areas are most at risk from subsidence:

| Ranking | Postcode | Town | Increase from 2021-22 |

|---|---|---|---|

| 1 | SE | London | 171% |

| 2 | BS | Bristol | 238% |

| 3 | B | Birmingham | 40% |

| 4 | N | London | 133% |

| 5 | SO | Southampton | 166% |

| 6 | LE | Leicester | 97% |

| 7 | NG | Nottingham | 50% |

| 8 | RG | Reading | 143% |

| 9 | CM | Chelmsford | 244% |

| 10 | NN | Northampton | 212% |

Table source. Which

The British Geological Survey (BGS) have provided maps of areas with estimated higher subsidence risk in the future.

Full Surveys to Detect Subsidence

When purchasing a property it is always worth getting a full survey, especially in an area prone to subsidence, as this will highlight any issues. Historical subsidence work should come with guarantees; as well as a Certificate of Structural Adequacy if the repairs were part of an insurance claim.

It is also worth considering the insurance implications of a house with subsidence, as often polices can be more expensive and providers limited.

However, there are simple actions you can take to help ensure that subsidence does not become your property nightmare, including:

- Keeping trees and shrubs cut back

- Checking water pipes for leaks and keeping guttering clear of debris

- Ensuring the materials around your property are porous, like gravel or grass, to allow for drainage.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

A Greener Way to Heat Your Home

With the ever increasing need to reduce the use of fossil fuels and carbon footprints, the Government is keen to promote renewable technology in our homes. The arrival of the Future Homes Standard (2), together with a decision that no new homes built after 2025 (Now 2035) will have fossil fuel heating systems, has increased the popularity of air and ground source heat pumps. Many new homes are now being built with either air or ground source heat pumps to provide the heating and hot water in the home.

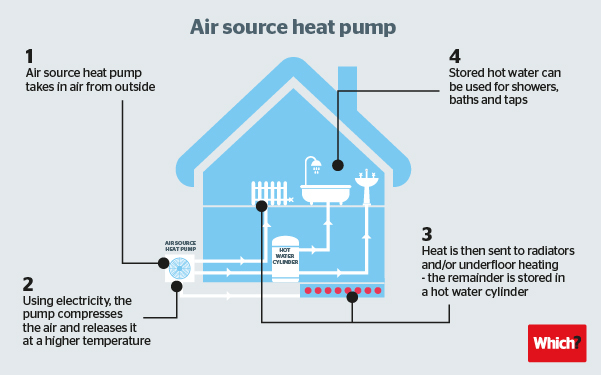

Air Source Heat Pump

An air source heat pump takes cooler air from outside and boosts its temperature using a compressor. It then transfers the heat to the heating system in your home via either an air-to-air or air-to-water system. Air-to-water is most suitable when using underfloor heating and large radiators. Air-to-air uses a warm air system to heat the home. Although it cannot heat water, it will also work as an air conditioning unit in the summer.

Image Source: which.co.uk

Costs ASHP

The cost of installing an air source heat pump in the UK can vary based on different factors. Here are some typical costs involved:

- According to the Energy Saving Trust, the average cost of installing an air source heat pump in the UK ranges from £7,000 to £13,000

- The price of an air source heat pump can vary between £3,500 and £8,900 depending on factors like unit power, brand, government grants, and installation costs

- A high-quality air source heat pump system can cost from £8,000, with installation for a 250m2 property costing roughly an additional £6,000

- The total price of purchasing and installing a heat pump is usually around £14,000, with the potential to access government grants like the Boiler Upgrade Scheme to reduce costs

- The supply cost of an air source heat pump ranges from £2,400 to £12,350 depending on the type of system and installation complexity

These costs can vary based on the size of the property, specific requirements, and available grants or incentives

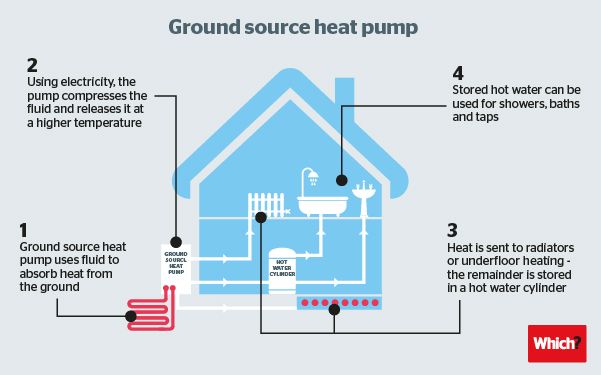

Ground Source Heat Pump

These work by harnessing the natural warmth underground and passing water pipes through it to absorb the heat. The heat pump increases the temperature and then uses it to pump heat around the home and to heat hot water. Only ground source heat pumps are eligible for the Government’s Renewable Heat Incentive.

Both systems use electricity. Because the temperature reached is not as high as with fossil fuels, the system must run longer in order to maintain a comfortable temperature.

Image Source: which.co.uk

GSHP Costs

The cost of installing a ground source heat pump in the UK varies based on factors like system type and size. Here are the typical costs:

- A basic ground source heat pump can range from £2,000 to £15,000, depending on size and brand

- The average cost for a ground source heat pump installation in the UK is between £16,200 to £49,000, including additional digging costs

- A 6-8 kW horizontal ground source heat pump system typically costs around £12,000 to £15,500 to install, while a larger 12kW system would be around £24,000

- Vertical ground source heat pumps are more expensive due to borehole drilling, with a 12kW system costing around £36,000

Pros and Cons of Ground & Air Pumps

Both systems are expensive to install, costing upwards of £9,000; and good insulation is a must if they are to be efficient. Air source heat pumps will need a large outdoor unit so space outside is necessary. These can be both noisy and cold in the immediate vicinity. Planning permission will also be required in listed buildings and conservation areas. However, on the plus side, they generate less CO2 than conventional systems. Some money is available via Government grants (1) to offset the initial costs. They are most economical when used in conjunction with renewable energy providers such as solar panels, using the energy generated to run the pumps.

With the change in attitude of the home buyer, the house builders see the advantages of building with these new technologies as an asset to the home. And, fitting systems during building is much less disruptive and more efficient than replacing an old system.

It would seem this must be the way forward for us all.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

References

To Buy or Not to Buy: Adding Housebuilders to Your Share Portfolio

It would certainly seem like a good time to invest in housebuilders; with shares in the big names having all risen during 2021.

It would certainly seem like a good time to invest in housebuilders; with shares in the big names having all risen during 2021.

The pandemic changed the way people value their home and what they need it from it. This is reflected in the record high of the average house price, which now stands at £262,954 according to the Halifax.

The Government has introduced planning reforms to enable more homes to be built to meet its targets to reduce housing shortages. This means there is plenty of business to be had for the big housebuilders.

The largest housebuilding companies saw share prices increase by up to 32% (Vistry); 30% Crest Nicholson, 27% Redrow and 17% Bellway.

But it is not all plain sailing. Along with demand comes problems with supply, exacerbated by the pandemic, and shortages of both materials and labour. However, many see the opportunities outweighing the obstacles. The rising cost of materials is also being offset by the increase in house prices.

When looking to invest in this sector, it would seem that a good national spread of housing stock and sites, as well as a strong balance sheet, are key to getting a good return. Barratt is rumoured to be paying a special dividend next year. Bellway is already included in trusts such as Aurora, Independent and Mercantile.

Despite some of the housebuilders practices and quality of product, it is fair to say that without them the Government will not be able to fulfil their policies. This, therefore, must make them a contender for your portfolio.

For further information, please contact Ed or Kelly on tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Insurance Backed Guarantees (IBG’s)

What is an IBG?

An IBG is an Insurance Backed Guarantee. Despite its name, it is not a ‘guarantee’ but a policy that backs a guarantee. IBGs are also known as Guarantee Insurance Policies and Warranty Insurance Policies. However, it’s important to remember that all three terms refer to the same type of insurance product.

The objective of an IBG is to provide insurance backing to a written workmanship and/or material guarantee, provided by a building contractor to a commercial or domestic customer. Written guarantees are often given in good faith. However, the most reputable contractors are unable to guarantee their solvency to the extent that they will be able to resolve defects for the length of the guarantees.

Therefore, many contractors and warranty providers in the UK request that customers are provided with an IBG. This ensures that recourse to the written guarantee is viable in the event that the original contractor ceases trading.

Who provides the guarantee covered by the IBG policy?

Who provides the guarantee covered by the IBG policy?

At completion of the roofer or tanking contract, it is the responsibility of the installer to provide a guarantee. It is the installer’s promise to the customer that they will rectify any issues that may arise with the installation following completion.

This guarantee is the subject of the Guarantee Insurance Policy, and the IBG policy will reflect its terms.

Why do warranty companies need IBG’s?

IBG’s provide an extra layer of security by assuring the written guarantee provided will be covered, even if the original contractor ceases trading. So, it means the warranty provider has recourse against a third party.

How Much Do IBGs Cost?

How Much Do IBGs Cost?

The cost of IBG policies can vary depending on the contract value of the works and the nature of works undertaken. Also, the company’s history and nature of the product required.

As a general rule on a “good risk” we would expect premiums on Piling IBG to be Starting at 5% of the contract value and for Tanking and flat roofs to be in the region of 3-5% of the contract value for UK based contracts.

We are also able to look at cover for UK companies that carry out installation in aboard, viewed on a case by case basis.

Examples of available IBG products

- Flat Roofs

- Timber Treatment

- Cladding

- Lateral Restraint/Structural Beams

- Structural Waterproofing

- Basement Tanking

Build to Rent – An Asset to the Private Rental Sector

With growing reports on the poor state of private rental accommodation in big cities, the rise in build to rent properties has to be a good thing.

These properties are new build apartment blocks that have been built specifically for renters and cannot be sold on. They have to include at least 50 homes and they are all owned and managed by one landlord. They are designed, constructed and managed to a high-quality standard; created to address many of the problems that renters face from short-term leases to unscrupulous landlords charging exorbitant rents for poor quality housing.

Build to Rent property developers are leading the charge for a better way of renting, with no deposits, no fees, and longer tenancies for their residents. Often gardens are included in the development. And increasingly, sustainability and carbon footprint reduction are a part of the ethos.

Image Source: goodstoneliving.com/camp-hill-gardens.html

Goodstone Living

Goodstone Living is one such developer. Currently looking to develop in Digbeth, Birmingham, its Camp Hill Gardens will provide more than 500 Build to Rent homes. It will also include the largest private garden in the city with a strategy focused on “long-term value creation”. Along with the housing will be amenity space and co-working areas. There will also be dedicated commercial and retail space available at a 50% reduction to local businesses.

Martin Bellinger, Principal at Goodstone Living said: “Our strategy requires us to be able to identify significant regeneration opportunities… and to transform areas in need of new housing. As the UK’s second largest city by population, Birmingham benefits from a large and growing pool of potential residents demanding high-quality, purpose-built and professionally managed rental accommodation. This makes Birmingham the perfect place for our first development project.”

Developments such as these are being constructed across London and the key regional cities. The future is looking more promising for the ever-growing number of permanent renters in the property market.

For further information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

Copyright © 2024 Granite Building Warranties

Supported by Fox 360 Ltd

Granite Building Warranties Ltd is an Appointed Representative of Richdale Brokers & Financial Services Ltd which is authorised and regulated by the Financial Conduct Authority.

Granite Building Warranties is a company registered in England and Wales (Company Number 11497543) with its registered office at 1st Floor, 5 Century Court, Tolpits Lane, Watford, WD18 9PX