Over thirteen yearsexperience in the industry

We can offer aMarket comparison

Accepted bymajority of high street banks

Recognised byUK Finance

Types Of Planing Application Agents

Planning application agents are an integral part of the planning application. They are there to guide you through the complex rules and regulation which may even vary from each borough and council authority. Getting it wrong in the beginning could and months, even years to the whole process.

So lets explore what type of planning agents there are and when you might need them along with the projected cost implications.

Architect

An architect is someone who has been professionally trained and licensed to plan, design, and oversee the construction of buildings. Their skills, background, and fees can differ quite a bit depending on the size and complexity of the project.

Qualifications:

To become a licensed architect, the typical path involves:

- Earning a 5-year bachelor’s degree in architecture. (BArch) degree accredited by the Royal Institute of British Architects (RIBA) (https://www.architecture.com/)

- Completing an internship under a licensed architect (A minimum of two years of supervised work experience under a registered architect.)

- Passing the licensing exam. (You’ll need to pass the Part 3 qualification exam offered by RIBA. This assesses your architectural knowledge, design skills, and professional competence.)

Experience:

Architects can specialise in residential homes, commercial buildings, or landscape architecture. Their experience can range from recent grads to veterans with decades under their belt.

Costs:

Architect fees are commonly structured a few different ways:

- Percentage of construction cost: This is standard practice, where the architect’s fee is calculated as a percentage of the total estimated construction cost, often 8-15%+ depending on complexity and the architect’s experience.

- Hourly rate: Some architects bill by the hour, with rates varying based on experience and location.

- Fixed fee: For smaller projects, architects may agree to a fixed cost for defined services.

Here’s a rough estimate of fees based on project size:

Here’s a rough estimate of fees based on project size:

- Small residential project (renovation/addition): £5,000 – £15,000+

- Medium residential project (new single-family home): $15,000 – $30,000+

- Large residential project (custom luxury home): $30,000+

- Commercial project: Costs vary hugely depending on size and complexity

What Architects do:

- Initial consultation to discuss vision, budget, needs

- Site analysis to evaluate the property

- Schematic designs with preliminary concepts/floor plans

- Design development refining the plans

- Construction documents with detailed drawings/specs

- Bidding assistance and oversight during construction

When to hire an architect:

- For complex projects requiring specialised design expertise

- If you want a custom, unique design fitting your style

- To ensure permitting and code compliance

Planning Consultants

Planning consultants are specialists who can guide you through the planning/zoning approval process based on their expertise with local regulations and procedures.

Qualifications:

Degree in Planning, Urban Design or related field. Membership in the Royal Town Planning Institute (RTPI). (https://www.rtpi.org.uk/).

Experience: Most have several years working on planning applications.

Cost: Roughly £2,000 – £6,500+ per project depending on complexity

When to hire Planning Consultant

You should consider hiring a planning consultant in several situations related to obtaining planning permission for development projects. Here’s a breakdown of key scenarios where their expertise can be beneficial:

Complex Projects:

- Unfamiliar territory: If you’re unfamiliar with the planning process or local regulations, a consultant can guide you through the steps, paperwork, and potential challenges.

- Large-scale development: For complex or large-scale projects, a consultant can navigate the complexities and increase your chances of approval.

- Sensitive developments: Projects in historically significant areas, environmentally sensitive zones, or with potential for community objections might benefit from a consultant’s experience in dealing with such complexities.

Applications with a High Risk of Rejection:

- Previous refusals: If a similar project on the site was previously rejected, a consultant can analyze the reasons and develop a more successful strategy for your application.

- Non-standard proposals: Projects that deviate significantly from the local development plan or zoning regulations will need a strong case for approval, which a consultant can help build.

Surveyors

Surveyors provide expertise on property boundaries, constraints, and other site conditions.

Qualifications:

Chartered membership with the Royal Institution of Chartered Surveyors (RICS) requiring a surveying degree.

Experience: Qualified surveyors understand building codes well.

Cost: Around £650 – £2,600+ depending on survey type

When to hire Surveyor

Building or renovating: A surveyor can be crucial for:

- Site surveys: This establishes the property’s exact boundaries, topography (land elevation), and potential challenges for construction projects.

- Setting out foundations: Ensures the foundation for your new building is laid in the correct location and at the proper level.

Land development: For any significant land development project, a surveyor is necessary for:

- Land division: Dividing a larger piece of land into smaller plots requires accurate surveys to establish boundaries for each new parcel.

- Topographical surveys: Understanding the land’s elevation and features is crucial for planning construction projects,drainage systems, and overall development.

Landscape Architect

For major landscaping, a landscaping architect creates designs meeting planning requirements.

Qualifications:

Degree in landscape architecture and membership with the Landscape Institute (LI).(https://www.landscapeinstitute.org/about/).

Experience: Experienced in sustainable design and environmental regulations.

Cost: Around £1,300 – £3,000+ based on complexity

Environmental Consultants

Environmental consultants assess potential impacts and mitigation strategies.

Qualifications:

Degree in environmental science/ecology plus relevant certifications.

Many will also have certifications or memberships in relevant organisations depending on their area of expertise. For example, someone specializing in waste management might be certified by the Chartered Institution of Wastes Management (CIWM) (https://www.ciwm.co.uk/).

Experience: Look for consultants experienced with similar projects.

Cost: £1,000 – £10,000+ depending on assessment complexity

What they can do for your planning application:

- Environmental Impact Assessment (EIA): They can assess the potential impact of your project on factors like air quality, water resources, ecology, and noise pollution.

- Pollution control strategies: They can advise on ways to mitigate any negative environmental impacts and ensure compliance with environmental regulations.

- Sustainability reports: They can help develop reports that demonstrate your commitment to sustainable practices, which can be a positive factor in the planning decision.

When might you need an environmental consultant?

- If your project involves development in a sensitive ecological area.

- If your project has the potential to generate significant waste or air/water pollution.

- If your local planning authority requires an EIA for your type of project.

Building Engineers

Building engineers don’t typically work directly on submitting planning applications themselves. Their expertise is more involved in the design and technical aspects of the building itself, once the planning permission is secured.

Qualifications:

- Building engineers typically hold a degree in Civil Engineering, Mechanical Engineering, or a related field. They might also be members of professional bodies like the Chartered Institution of Building Services Engineers (CIBSE) (https://www.cibse.org/).

- Cost: Their involvement wouldn’t be a separate cost for the planning application process. Their fees would likely be part of the overall project cost for design and construction, which can vary significantly depending on the project size and complexity.

Structural Engineers

Structural engineers specialise in a building’s structural integrity and safety.

Qualifications: Chartered Civil/Structural Engineering degree and registration with the Institution of Structural Engineers (IStructE). (https://www.istructe.org/).

Experience: Look for direct structural engineering project experience.

Cost: Around £1,300 – £6,500+ depending on complexity

Notes On Cost Estimations

- Costs can vary significantly based on location, project specifics, and the professional’s experience level

- Get multiple quotes before deciding

- Some firms offer combined services which can save money

- Don’t hesitate to ask about qualifications and relevant experience

When to hire Structural ENGINEER

When to hire Structural ENGINEER

You should hire a structural engineer when your project deals with the building’s stability and structural integrity. Here are some common scenarios where their expertise is crucial:

-

New Builds: For any new construction project, a structural engineer is essential. They will:

- Analyze loads and stresses on the building from weight, wind, and other factors.

- Design the building’s structural framework, including foundations, beams, columns, and floors.

- Specify the appropriate building materials for strength and durability.

- Ensure the building complies with building codes and safety regulations.

-

Renovations and Extensions: If your renovation project involves changes that impact the building’s structure,you’ll need a structural engineer. This could include:

- Removing load-bearing walls

- Adding a new floor or roof

- Modifying existing support structures

- Adding features like balconies or large windows

-

Structural Repairs: If you suspect or discover structural damage to your property, consulting a structural engineer is essential. They can assess the damage, determine the cause, and recommend solutions for repair or reinforcement.Examples include:

- Cracks in foundation or walls

- Uneven floors or sagging ceilings

- Signs of water damage that might affect structural stability

Caveats

- The above are estimated costs and can vary depending on your location, the project’s specifics, and the professional’s experience level.

- It’s always best to get quotes from several professionals before deciding.

- Some firms offer combined services (e.g., planning consultant and surveyor), which can be more cost-effective for smaller projects.

Remember, the qualifications and experience required can also vary depending on the project’s complexity and local regulations. Feel free to ask potential agents directly about their qualifications and experience.

For more information, please contact Ed or Kelly on 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

The poorly thought out Conservative Government Health and Safety Rules regarding shrinking the size of windows in new developments look set to be scrapped.

Michael Gove’s plans to make upstairs windows at least 1.1 metres from the floor are leading to new developments having smaller windows with dark and gloomy interiors.

It was feared that global warming would lead to more windows being opened for longer that led to the regulations being introduced. However a review is due to be published shortly and industry hope is that this strange rule will be axed.

Some critics have said new homes that have been built adhering to the new rules, have upper storey windows that appear squashed in appearance.

Options to get around the regulations cost money and lower budget properties will suffer as developers are not prepared to invest more money.

Rico Wojtulewicz, spokesperson for the National Federation of Housebuilders said the regulations are “making it difficult …. to deliver unique and beautiful homes.”

Also there is confusion with Local Authorities and Building Control who fail to understand the new regulations.

The Housing Department will publish their report later this year, hopefully providing a better result for the development sector.

References

- Gove

- Wojtulewicz

- Planing Portal – Doors -Windows, Here

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Housing market outlook more positive for 2024

The reduction in rates from the mortgage lenders has brought a cautionary optimism to the outlook for the housing market in 2024.

The Halifax announced a reduction of 0.83% for its 2, 5 and 10 year fixed rate products increasing to 0.92 per cent for existing customers.

The Halifax also confirmed it will be reducing its remortgage rates by up to 0.32% on selected 3-year fixed rates from Friday, 5th January 2024. This mid range fixed rate is not offered by many lenders and is often seen as good middle ground for those looking to remortgage.

All this activity looks likely to prompt other lenders to follow suit.

With inflation falling faster than expected pressure is on the Bank of England to reduce interest rates and encourage further falls in mortgage rates.

Competition amongst lenders is fierce with in a smaller market place – first time buyers with a mortgage fell to a 10-year-low of just 290,000 in 2023.

Despite market indicators still showing a negative trend, sales expectations are looking positive for the first time in three months with a rise of 6% expected and looking toward the future, a 24% increase in sales is forecast in the next twelve months, the most positive outlook since January 2022.

According to Rightmove the number of homes being listed by estate agents on Boxing Day 2023 has nearly tripled (+173%) since pre-pandemic 2019.

Although house prices still look set to continue in decline the rate of decline is slowing.

According to Simon Rubinsohn, RICS chief economist, “The latest RICS Residential Market Survey provides further evidence that sentiment is a little less negative than previously was the case with, critically, the new buyers enquiries indicator finally beginning to stabilise.

“This is being aided by increased confidence that the interest rate cycle has peaked which is reflected in somewhat more competitive mortgage products coming to the market.

“However, with the cost of money likely to remain elevated for some time to come and the economic outlook still downbeat, it is not surprising that the overall tone to the anecdotal remarks from survey respondents is still quite cautious.”

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Blue Chip Developers Will Fall Short of Building Targets in 2024

- Forecasts from Peel Hunt show the 10 stock market listed developers are expected to build only 69,300 new residential dwellings in 2024.

- This falls far below the 85,000 completed in 2022 and is still less than the 71,000 completed in 2023.

- This significant reduction seriously jeopardises Government targets of 300,000 new homes being built each year by all developers by mid-2020’s.

- Companies blame withdrawal of Help to Buy, planning red tape, Brexit and lack of skilled labour as significant reasons for lack of homes being built – the environment is increasingly anti-development.

- Other causes for the shortfall include cost of living crisis, mortgage rate rises, falling house prices and shortage of housing stock.

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Loft conversions – do they still make financial sense?

When looking to increase space in your home one of the most popular choices has often been to go upwards into the loft, but with soaring building and timber costs does this still represent value for money?

Average building costs are around £250-£300/sq ft so a couple of bedrooms and a bathroom could cost around £120,000 but could add around £150,000 to the value of the home thereby making this a good investment.

Adding an extra bedroom and bathroom to a smaller house will be more likely to increase its value as you are widening its appeal to a larger market sector. However, adding too many bedrooms and having not enough living space to accommodate everyone or ending up with an unbalanced home or overdeveloped plot will not be attractive to buyers, even if it works for you.

In the current market, with falling house prices, a loft conversion in some areas is unlikely to add value in the short term but stay put for a few years and a well-balanced conversion is likely to give you a good return on your investment.

As is the case with all significant building projects, you will need a structural warranty. Please contact Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Your basement transformation journey has reached its exciting final phase! With the construction complete, it’s time to bring your vision to life by equipping this newfound space with all the essentials. From cosy furnishings and innovative lighting to the latest in insulation and heating solutions, we’re here to guide you through the finishing touches that will turn your basement into a functional, comfortable, and vibrant extension of your home

Optimising Basement Flooring

Consider your options carefully if dealing with an uneven basement floor. A standard solution is adding screeds, or concrete layers, atop the floor slab. Screeds offer a solid base for various finishes but can increase floor height. Alternatively, floating timber floors, constructed from tongue and groove boards over a waterproof membrane and insulation, offer a practical solution. Incorporate underfloor heating for added comfort and efficiency.

Insulating Your Basement for Comfort and Efficiency

Insulation is key to a welcoming, energy-efficient basement. Focus on interior wall insulation, as exterior insulation is typically part of the initial construction process. Affordable options include:

- Blanket Insulation: Fiberglass insulation with a vapour barrier, but beware of moisture sensitivity.

- Foam Board Insulation: Excellent for water resistance, attaches well to cavity drainage membranes.

- Loose-fill Insulation: A cost-effective alternative.

- Sprayed Foam Insulation: Ideal for finished basements.

- Remember, proper vapour control is essential to prevent humidity and mould. Install a vapour control layer on the insulation’s warm side to stop condensation. Waterproofing systems are crucial to protect the insulation from water damage. Note the U values (lower values indicate better insulation) to gauge heat loss efficiency.

Ensuring Proper Ventilation

Proper ventilation is critical in basements to replace stale air and control humidity. Utilise windows, open staircases, extractor fans, and ventilation units effectively. Also ensure the basement is waterproof.

Basement Heating Options

A cosy basement needs adequate heating. Options include:

- Underfloor Heating: Efficient and evenly distributed; often installed in screeds.

- Radiators: A traditional heating choice.

- Electric and Oil Heaters: Good for short-term heating but consider cost-effectiveness.

Lighting Solutions for a Bright Basement

Basements often lack natural light, so creative lighting is essential. Avoid pendant lights in low-ceiling basements, opting instead for:

- Recessed Miniature Spotlights: Ideal for low ceilings.

- Spotlights and Track Lighting: Attach to ceiling beams for focused illumination.

- Wall Sconces: For ambient light.

- Maximise natural light by keeping windows unobstructed. Consider installing or enlarging windows or adding a lightwell, subject to planning permissions. Glass doors and innovative options like mirror shafts can also introduce more light.

- Natural Light: Basements often have limited natural light. If your basement has windows, maximize this natural light. Consider using light window treatments and strategically placing mirrors to reflect natural light.

- Artificial Lighting Types:

- Ambient Lighting: This is the general, overall light in the room. Recessed lighting, flush-mount ceiling fixtures, or even wall sconces can provide good ambient light.

- Task Lighting: For areas where specific activities occur (like reading, working, or playing games), additional lighting like table lamps, floor lamps, or under-cabinet lights can be used.

- Accent Lighting: This is used to highlight architectural features, artwork, or other points of interest. Track lighting or spotlights can be effective for this purpose.

- Ceiling Height: Lower ceilings in basements may not accommodate certain types of fixtures. Flush-mount or recessed lighting can be a good choice in these areas.

- Color Temperature: Warmer light (2700K to 3000K) often works well in basements to create a cozy and inviting atmosphere. Cooler light might be preferred in work or utility areas.

- Energy Efficiency: LED lighting is a popular choice for basements due to its energy efficiency and long lifespan. It also produces less heat, which is a plus in a confined space.

- Brightness: Basements often need more light than other rooms due to the lack of natural light. Ensure your lighting plan includes enough lumens to adequately brighten the space.

- Flexibility: Dimmer switches can be a great addition to control the lighting mood and intensity. Adjustable lights or track lighting offer flexibility to change the direction of light as needed.

- Safety and Building Codes: Make sure your lighting plan complies with local building codes, especially regarding electrical wiring and fixture installation.

- Decor and Style: The lighting should complement the overall decor and style of your basement. Choose fixtures that enhance the aesthetic you’re aiming for, whether it’s modern, rustic, industrial, etc.

- Budget: Consider the cost not just of the fixtures themselves, but also of installation and long-term energy usage.

Enhanced Guide Elements:

- Soundproofing: Incorporate acoustic insulation if the basement is used for noise-related activities.

- Safety Features: Ensure emergency exits meet building codes. Install smoke and carbon monoxide detectors.

- Wall and Ceiling Finishes: Use moisture-resistant materials for walls and ceilings. A drop ceiling can offer easy access to utilities.

- Window Treatments: Light-filtering treatments provide privacy and natural light.

- Furnishings: Opt for space-efficient furniture, especially in smaller basements.

- Wi-Fi and Technology: Consider Wi-Fi extenders and smart home devices for enhanced connectivity and convenience.

- Compliance with Regulations: Adhere to local building codes, especially for egress windows and ceiling heights.

By enhancing your basement conversion guide with these additional considerations, you can create a space that is functional and comfortable but also safe and compliant with local regulations.

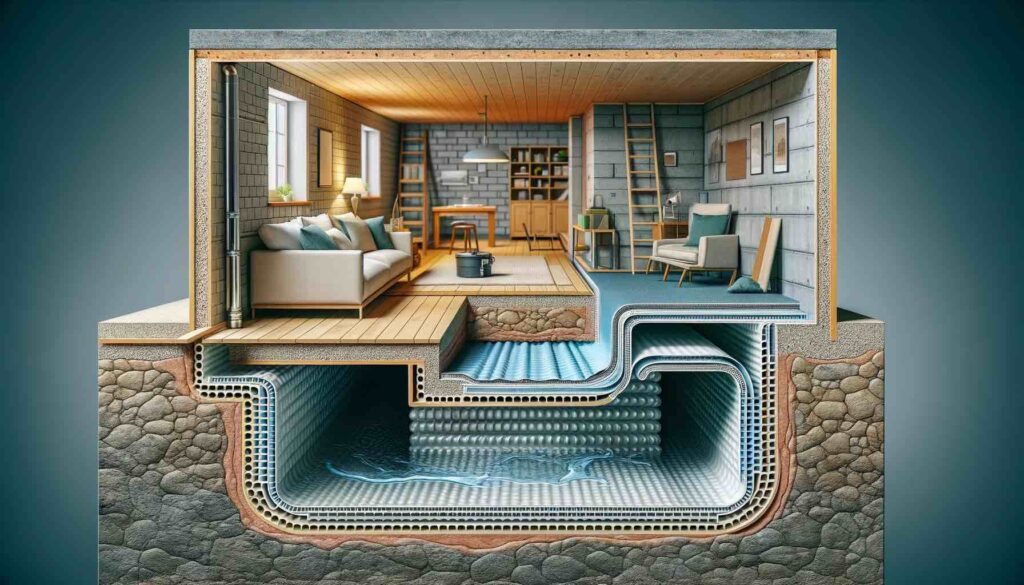

Transforming Basements into Dry, Welcoming Spaces: The Essentials of Waterproofing

Creating a Habitable and Dry Basement Space

The primary goal of basement conversions is to extend your living space into a welcoming and, most importantly, dry area. The key to achieving this lies in effective basement waterproofing.

Methods of Basement Waterproofing

The process of waterproofing a basement includes blocking water entry. It can be achieved through various techniques such as:

- External Waterproofing: This method is typically implemented during the basement’s construction and relies on moisture-resistant building materials. However, its effectiveness is often only thoroughly tested once the surrounding soil settles, potentially revealing flaws under hydrostatic pressure.

- Cementitious Tanking Involves applying a bonded waterproof cement layer to the basement’s walls, floors, and sometimes ceilings. This layer, adhering to the masonry, creates a barrier against water, allowing breathability.

- Cavity Drain Membranes: These membranes form a gap between the wet wall and the waterproof layer, guiding any water ingress to a sump and pump system for evacuation.

Best Practices for Waterproofing a Basement

The most effective waterproofing approach considers the basement’s intended use and combines various waterproofing systems. Each method has its strengths and should be tailored to suit specific conditions.

Preparing for Waterproofing

Before waterproofing, ensure to:

- Clear the basement of all items.

- Thoroughly clean the area, removing debris and dust.

- Inspect and repair any wall damage.

Choosing a Waterproofing Professional

Choosing a Waterproofing Professional

For optimal results, engage a professional specialising in basement waterproofing. Verify their credentials, focus on the guarantees offered, and consider if they are affiliated with organisations like the British Structural Waterproofing Association.

Enhancing Property Value with a Waterproof Basement

A waterproof basement prevents mould and rot and significantly increases property value. This added living space is particularly appealing in urban, high-value areas, especially London.

The Importance of BS8102 Compliance

All waterproofing systems should comply with the BS8102 guidelines. Familiarise yourself with these standards and the importance of sump pump maintenance and backup systems.

Waterproofing and Housing Considerations

A dry, welcoming basement property is more valuable and appealing to buyers than one with damp issues. Addressing waterproofing effectively can prevent long-term structural problems and make your property more attractive in the housing market.

Interior Drainage Systems

Interior drainage systems are crucial in basement waterproofing, especially in managing and redirecting water infiltration. Here’s an overview of how they work and why they are essential:

1. Functionality of Interior Drainage Systems:

- Interior drainage systems are designed to capture water that enters the basement, typically where the floor meets the walls, a common entry point for water.

- These systems consist of a drainage channel installed around the perimeter of the basement floor. The drain collects incoming water and directs it to a collection point, usually a sump pump.

2. Components of the System:

- Drainage Channel or Perimeter Drain: A trench is dug around the perimeter of the basement, and a drainage pipe or channel is installed. This pipe is perforated to allow water to enter and is often laid in a gravel bed to facilitate drainage.

- Sump Pump: The collected water is directed to a sump basin. When the water in this basin reaches a certain level, the sump pump activates and pumps the water out of the basement, typically discharging it away from the foundation.

- Vapour Barrier: Sometimes, a vapour barrier is also installed along the basement walls to direct wall seepage to the drainage channel.

3. Installation Process:

- Installing an interior drainage system typically involves some level of basement excavation. It may require the removal of a section of the basement floor along the perimeter and potentially the lower section of the basement walls.

- After installing the drainage channel and connecting it to the sump pump, the floor is restored, often with new concrete poured over the drainage system.

4. Advantages:

- Less Invasive: Compared to exterior waterproofing, interior drainage systems are less invasive and can be more cost-effective, as they don’t require excavating the entire outer perimeter of the house.

- Effective Water Management: They effectively manage water intrusion, redirecting it away from the basement living space.

- Reduced Hydrostatic Pressure: By capturing water at the point of entry, these systems help reduce hydrostatic pressure against the basement walls and floor, minimising the risk of structural damage.

5. Maintenance and Considerations:

- Regular maintenance of the sump pump and cleaning of the drainage channels is essential to ensure the system functions correctly.

- Battery backup systems for sump pumps are recommended to ensure functionality during power outages, which often accompany heavy storms.

6. Suitability and Limitations:

- Interior drainage systems are a practical solution for many basements but may only be suitable for some. Factors like the basement’s existing construction, soil conditions, and the water table level need to be considered.

- In cases of extreme flooding or severe foundational issues, additional waterproofing methods might be necessary.

Interior drainage systems offer an effective way to manage basement water issues, particularly with other waterproofing strategies. However, it’s crucial to assess each situation individually and consult with waterproofing professionals to determine the most appropriate solution for your basement needs. More on basement conversions.

Once the basement is waterproofed then it’s time to finish the basement.

For further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk.

The United Kingdom is currently grappling with a significant housing crisis, a situation where a substantial segment of our population lacks access to safe, suitable, and affordable housing. The government’s ambitious target of constructing 300,000 homes annually remains unmet, leaving many to question the root causes and potential solutions to this pressing issue.

Autumn budget pledged 180,000 new and affordable homes annually, however the real figure is in excess of 300,000 homes.

Underlying Causes of the Housing Shortage

Limited Supply of Homes: One of the principal reasons for the housing crisis is the acute shortage of housing. Despite the government’s commitment to building new homes, there’s a marked discrepancy between the number of houses available and the growing demand. This imbalance has escalated house prices and rental costs.

Population Growth: The UK has experienced a steady increase in population over the past decades, intensifying the demand for housing.

Affordability Issues: The high cost of housing, an increase of 34% since targets announced in 2017 compounded by the living cost crisis, has made it increasingly difficult for individuals and families to afford suitable housing. There is a need to build the right sort of houses.

Diminishing Social Housing: The availability of social housing, which offers affordable accommodation to those in need, has declined over the years.

The Impact of the Buy-to-Let Market: The trend of purchasing properties for rental purposes has reduced the number of homes available for purchase, thereby inflating prices and placing additional hurdles for first-time buyers. But many landlords are currently selling up which increases the stock for buyers but puts more pressure on rental market.

Regional Disparities: The crisis is more acute in densely populated areas and cities where job opportunities and economic growth have led to higher housing costs.

Planning

The current planning system is out of date and under resourced. An urgent overhaul is required to speed up the planning process, which will allow sites to move forward more quickly.

Labour

There remains a shortage of skilled trades to build the houses due to Brexit and Covid.

Government’s Challenges in Meeting Housing Targets

The government’s aspiration to build 300,000 homes annually has been declared unachievable by industry experts. Policy changes, including making local housing targets advisory, have led to a projected decline in annual housebuilding. Additionally, only 40% of local planning authorities have up-to-date local plans, with debates over housing numbers causing further delays.

Granite Building Warranties’ Perspective on Solutions

At Granite Building Warranties Ltd, we believe addressing this crisis requires a multifaceted approach:

- Planning: Improving the planning process, reducing the timeline and incentivising development on underutilised land.

- Improving Renting Conditions: Implementing stricter regulations for rental properties and enhancing tenant rights. However, this can cause reduction in rental properties as landlords are fed up with increasing regulations and decide sell up.

- Focusing on Sustainable Housing: Promoting environmentally friendly construction and innovative housing solutions.

- Prioritising Affordable Housing: Increasing public and private funding for affordable and social housing projects.

- New Construction Methods: Encouraging construction methods that ill speed up the build process.

- New Towns/Settlements: Government needs to identify new areas for substantial developments, such as Cambourne and North Stow in Cambridgeshire.

- Affordability and help for First Time Buyers: Now that Help to Buy is no longer available the Government needs to introduce a new scheme to support first time buyers.

Granite Building Warranties are specialist independent brokers of building warranties for the construction industry and for a quote or further information please contact Ed or Kelly on Tel: 01284 365345 or email ed@granitebw.co.uk / kelly@granitebw.co.uk

Expanding your living space through home extensions is a popular way to adapt your home to changing needs in the dynamic housing market. Whether you’re looking for an extra bedroom, a larger kitchen, or just more living space, understanding the different types of home extensions and their specific requirements is crucial. This guide explores London’s most common types of home extensions, along with insights into insurance and warranty considerations for each.

1. Single-Story Extensions:

Ideal for ground or first-floor expansions, single-story extensions are a cost-effective way to add rooms like bedrooms, bathrooms, or additional living space. They are less complex and generally more budget-friendly.

Insurance and Warranty Considerations:

- Site Insurance: Essential during construction to protect against risks like theft, damage, or injury on site.

- Structural Defects Insurance: Important for new construction to cover any structural issues that may arise post-completion.

- Completed Housing Warranty/New Build Warranty: Applicable for new extensions as a guarantee against defects.

- Latent Defects Insurance: Provides coverage for hidden defects discovered after completion.

- Right-of-Lights Insurance: May be necessary if the extension could potentially block a neighbour’s natural light.

2. Two-Story Extensions:

A two-story extension adds considerable room for those needing substantial space by building an additional floor. Perfect for multiple new rooms or expanded living areas.

Insurance and Warranty Considerations:

- Site Insurance: Essential during construction to protect against risks like theft, damage, or injury on site.

- Structural Defects Insurance: Important for new construction to cover any structural issues that may arise post-completion.

- Completed Housing Warranty/New Build Warranty: Applicable for new extensions as a guarantee against defects.

- Latent Defects Insurance: Provides coverage for hidden defects discovered after completion.

- Right-of-Lights Insurance: May be necessary if the extension could potentially block a neighbour’s natural light.

3. Wraparound Extensions:

These extensions expand the side and rear of your home, offering a spacious, open-plan area. They are ideal for combining with kitchen extensions but have a higher price tag.

Insurance and Warranty Considerations:

- Site Insurance: Essential during construction to protect against risks like theft, damage, or injury on site.

- Structural Defects Insurance: Important for new construction to cover any structural issues that may arise post-completion.

- Completed Housing Warranty/New Build Warranty: Applicable for new extensions as a guarantee against defects.

- Latent Defects Insurance: Provides coverage for hidden defects discovered after completion.

- Right-of-Lights Insurance: May be necessary if the extension could potentially block a neighbour’s natural light.

4. Conservatory Extensions:

Conservatories add a glass-walled living area, usually at the back of the house. Due to energy efficiency concerns, they’re less expensive than traditional extensions but might not be suitable for year-round use.

Insurance and Warranty Considerations:

- Site Insurance: Needed during the building phase.

- Structural Defects Insurance: To cover potential structural issues with the new construction.

- Completed Housing Warranty: For post-completion peace of mind.

5. Basement Extensions:

Transforming your basement into a functional area adds valuable space but can be complex and costly, often requiring structural modifications. However, we take a look at the benefits that could be had by having a basement conversion.

Insurance and Warranty Considerations:

- Site Insurance: Crucial during the construction process.

- Structural Defects Insurance: To cover structural issues, especially important given the complexity of basement works.

- Latent Defects Insurance: Useful for any hidden defects that might arise later.

- Retrospective Building Warranty: If modifying an existing basement, this may be applicable.

6. Loft Conversions:

Loft conversions are perfect for utilizing unused attic space. They can be complex, possibly requiring structural reinforcement, but effectively add rooms like bedrooms or bathrooms.

Insurance and Warranty Considerations:

- Structural Defects Insurance: To cover any potential structural issues post-conversion.

- Retrospective Building Warranty: Useful for conversions of existing structures.

- Self-Build Warranty: If the loft conversion is a DIY project.

7. Garden Living Pods:

Garden living pods are modern, standalone structures that offer an innovative solution for adding functional living space. Ideal for home offices, studios, or guest rooms, these pods provide flexibility and can often be installed with minimal disruption.

Insurance and Warranty Considerations:

- It’s essential to check whether your home insurance extends to cover external structures like garden pods.

- Ensure that the pod has a warranty, particularly on weather resistance and structural durability.

From traditional extensions to innovative garden living pods, expanding your home offers various options to suit different needs and preferences. Remember to factor in the aesthetic and practical aspects, essential insurance adjustments, and warranty protections for your new space. Whether you choose a loft conversion, a basement extension, or a trendy garden pod, thorough planning and professional advice are key to a successful home expansion project.

FAQ

What is the most cost effective way to increase the value of your home when expanding living space?

Answer: Adding Another Bathroom: Affixing a half-bath onto the side of your house or transforming an existing half-bath into a full-size bathroom can be surprisingly affordable and can greatly increase the value of your home

What are the legal requirements for building a home extension in the uk?

In the UK, there are specific legal requirements for building a home extension. These include obtaining planning permission and complying with building regulations. Here are the key points to consider:

- Planning Permission: It is essential to understand the planning permission requirements for home extensions in the UK. This involves confirming compliance with local planning restrictions, considering the impact on neighboring properties and the environment, and obtaining prior approval for larger extensions

- Building Regulations: All home extensions in the UK must meet building regulations. This ensures that the extension meets safety standards, complies with legal requirements, and maintains the structural integrity of the property. Building regulations cover aspects such as structural integrity, safety, electrical, plumbing, and fire safety requirements

- Permitted Development: Some home extensions may fall under permitted development rights, allowing them to bypass the traditional planning process. However, there are specific criteria and limitations that must be met to qualify for permitted development

References

- Building Regulations 2010

- Planning Permissions (England & Wales)

- Permitted Development (Rights For Householders)

The past decade has witnessed notable fluctuations in the UK housing market, with prices experiencing dramatic increases and notable dips. This comprehensive overview explores the factors and specific events that have shaped house prices over the last ten years.

Key Drivers of House Price Trends

Supply and Demand Dynamics:

The fundamental driver of house prices is the balance between supply and demand. In recent years, rising population growth, increased household formation, and growing disposable incomes have significantly boosted demand. This, coupled with inadequate supply, has led to a sustained rise in house prices.

Influence of Interest Rates:

Interest rates play a crucial role in housing affordability. Lower interest rates make borrowing cheaper, thus fuelling demand and escalating prices. On the other hand, higher interest rates make mortgages more expensive, dampening demand and slowing price growth.

Impact of Government Policies:

Initiatives like Help to Buy have made homeownership more accessible, stimulating demand and, consequently, prices. These policies often aim to support specific market segments, such as first-time buyers.

Economic Conditions:

The strength of the economy significantly influences house prices. Economic booms encourage spending and investment in housing, while recessions typically lead to cautious spending and stagnation in the housing market.

Specific Events Impacting House Prices

Specific Events Impacting House Prices

- 2013: The government introduced the Help to Buy scheme, which made it easier for people to buy homes with a small deposit. This led to increased demand for housing and a rise in prices.

- 2015: The government introduced a new stamp duty surcharge for buy-to-let properties and second homes.This was designed to make it more expensive for people to buy second homes and to free up more homes for first-time buyers. However, it had little impact on house prices.

- 2016: The UK voted to leave the European Union. This caused uncertainty in the economy and led to a fall in the value of the pound. This made it cheaper for overseas investors to buy property in the UK, which helped to boost demand and prices.

- 2017: The government introduced a new stamp duty band for properties valued at over £1 million. This was designed to raise revenue and to make it more expensive for people to buy expensive homes. However, it had little impact on house prices overall.

- 2019: The government introduced a number of measures to help first-time buyers, including a new First Homes Fund and a new Help to Buy scheme. These measures were designed to make it easier for first-time buyers to get onto the property ladder.

- 2020: The COVID-19 pandemic caused a temporary dip in house prices. This was due to a number of factors,including a fall in consumer confidence, a decline in economic activity, and a temporary halt to the housing market. However, prices have since rebounded and are now higher than they were before the pandemic.

- 2021: Stamp Duty Holiday: The government introduced a temporary stamp duty holiday from July 2020 to September 2021, removing the tax on property purchases up to £500,000 and £250,000 for first-time buyers. This significant incentive fuelled a surge in demand and drove up house prices.

-

Continued Low Interest Rates: Despite the pandemic, the Bank of England maintained low interest rates, making mortgages more affordable and further supporting demand for housing.

-

-

2022: Return to Pre-Pandemic Price Levels: House prices surpassed pre-pandemic levels, reaching record highs in several regions. The combination of pent-up demand, low interest rates, and the lingering effects of the stamp duty holiday continued to drive market activity.

-

Rising Inflation: Inflation began to rise sharply, putting pressure on the Bank of England to raise interest rates. This shift in monetary policy signaled a potential slowdown in the housing market.

-

-

2023: Interest Rate Hikes: The Bank of England responded to rising inflation by raising interest rates several times throughout the year. These increases have impacted affordability, leading to a moderation in house price growth.

-

Economic Uncertainty: The ongoing war in Ukraine, global supply chain disruptions, and the lingering effects of the pandemic have created economic uncertainty, which could influence future house price trends.

-

Summary

The last decade has seen a complex interplay of factors influencing the UK housing market. From supply-demand imbalances and economic shifts to government policies and global crises, these elements have steered house prices on an eventful journey.

While the market has shown resilience and growth, it remains subject to cyclical trends and future uncertainties. As we look ahead, it is crucial to approach the housing market with a well-informed and balanced perspective, recognising that while growth has been robust, it is not guaranteed to persist indefinitely.

With the rising costs of housing prices this has also had an effect on a 10 year new build warranty. Of course at Granite we strive to be a competitive provider in the marketplace.

Reference

Copyright © 2024 Granite Building Warranties

Supported by Fox 360 Ltd

Granite Building Warranties Ltd is an Appointed Representative of Richdale Brokers & Financial Services Ltd which is authorised and regulated by the Financial Conduct Authority.

Granite Building Warranties is a company registered in England and Wales (Company Number 11497543) with its registered office at 1st Floor, 5 Century Court, Tolpits Lane, Watford, WD18 9PX